When Will Mortgage Rates Fall?

Author: Kevin Graham

Mortgage rates have gone up substantially over the past couple of years. While there is no doubt that this makes things harder for home buyers already dealing with high home prices and those looking to refinance, interest rates move in cycles. We’ll look at some of the typical indicators to show you when to expect mortgage rates to fall again.

Where Are Mortgage Rates Now?

Before we get into how to look at where they might be going, let’s start with a baseline on where they are. For that, the most widely used metric is the Freddie Mac Primary Mortgage Market Survey®. As of this writing, the average rate for a 30-year fixed mortgage is 6.61%. That’s up from 6.42% at this time last year and 3.11% at the start of 2022.

Mortgage Rate Predictions

Members of the Federal Reserve (often simply called “the Fed”) have been pretty clear on the fact that they feel interest rates need to be higher for longer to get a handle on persistently high inflation.

We’ll get into more depth on how the Federal Reserve’s decisions impact mortgage rates later, but what do housing market experts think about the direction of rates?

It’s safe to say there is no broad consensus. Looking at forecasts for 2024, the National Association of REALTORS® feel rates will average about 6.3%, while realtor.com economists are projecting rates to only hit 6.5% by 2025.

Meanwhile, both the Mortgage Bankers Association and Fannie Mae’s forecasts have rates as low as 6.1% this year.

The thing about forecasting is it’s a messy business. Even people whose job it is to follow this on a regular basis can have wildly divergent opinions. Then there’s the fact that no one has a DeLorean with a flux capacitor, so it’s impossible to know the future.

You’re not going to see a prediction of what mortgage rates will be on May 7, 2026, in this article. But we do promise to look at various indicators and how to think about them.

What Affects Mortgage Rates?

Before we get too deep into trend indicators for those who insist on reading mortgage rate tea leaves, let’s take a brief look at the factors that impact mortgage rates. Really, they can be broken down into two categories: market conditions and personal financial characteristics.

Market Conditions

It used to be that if a financial institution gave you a mortgage, they would hold onto it on their books for as long as it took a client to pay off the mortgage under the terms of the loan. There were weaknesses to this in that there is limited money to lend if you’re constantly waiting to recoup money you’ve lent.

While some institutions do still hold loans (portfolio lending), most lenders now sell to major mortgage investors like Fannie Mae or Freddie Mac. These investors buy loans that meet their guidelines. Individual loans are then packaged into mortgage-backed securities (MBS), which can be purchased by individual or institutional investors.

The MBS market provides important sources of fast funding so more mortgages can be originated. However, this is where market dynamics come into play.

MBS are sold on the bond market. The upside of bonds is that they offer a guaranteed rate of return. They can, however, be susceptible to inflation risks. If the value of your bond is locked in at a rate lower than inflation, your money has lost value. Moreover, there’s the potential to earn more in the stock market. Both factors play a role in mortgage rates.

In situations where people anticipate inflation will be higher, they’ll demand higher bond yields (including from MBS) to compensate. Additionally, if people think the economy is doing well, they might invest in stocks for the higher return possibility. On the other hand, if people are more pessimistic, higher demand for bonds means lower yields.

The yield on mortgage-backed securities directly impacts the prime rate that mortgage lenders can charge their most qualified borrowers. Higher yields on MBS mean higher rates, while lower yields will drop the rate.

Put simply, often “bad news” for the economy, or geo-political risk, can lead to lower mortgage rates, where “good news” for the economy as a whole usually pushes mortgage rates higher.

Personal Financial Characteristics

Responsible lending is all about making sound judgments of risk based on empirical data. Clients who are perceived as a lower risk will receive slightly better interest rates than those who might have a higher risk. There are several ways lenders quantify risk, but here are three of the biggest factors that specifically impact interest rates:

- Credit score: Higher scores will typically lead to lower rates because it’s an indicator that you’ve shown the ability to handle finances responsibly.

- Down payment: Higher down payments often lead to lower rates because there’s less risk if lenders don’t have to loan as much money.

- Occupancy: If everything else is held equal, you’ll receive a lower rate on your primary residence than you would on a vacation home or investment property. Lenders know that if you were ever to get into financial trouble, you would prioritize the payment on the home you live in over the others.

These are often driven by the guidelines set by the mortgage investors, like Fannie Mae and Freddie Mac, rather than the specific lender – although there may be some slight differences depending on which lender a home buyer is working with.

What Are the Factors Impacting Mortgage Rates?

You can work on your personal financial situation to achieve a better rate, but that’s not the factor that’s driving mortgage rates higher industrywide, so let’s look at what does tend to move the mortgage market.

Inflation And The Federal Funds Rate

Two of the missions set out by Congress in the Federal Reserve Act are for the central bank to maintain price stability while also supporting the conditions necessary for maximum employment. Those goals can often work in opposition to each other.

When interest rates are low, money is cheaper to borrow, meaning businesses can use it to expand operations, requiring bigger payrolls. At the same time, because money is easy to get, people are generally more willing to part with more of it, which drives up demand and can increase prices if there’s a supply mismatch, triggering inflation.

The Federal Reserve wants to see inflation around 2% per year because it keeps the economy going by encouraging people to buy now. However, too much inflation makes the money that people earn worth relatively less both here and potentially overseas.

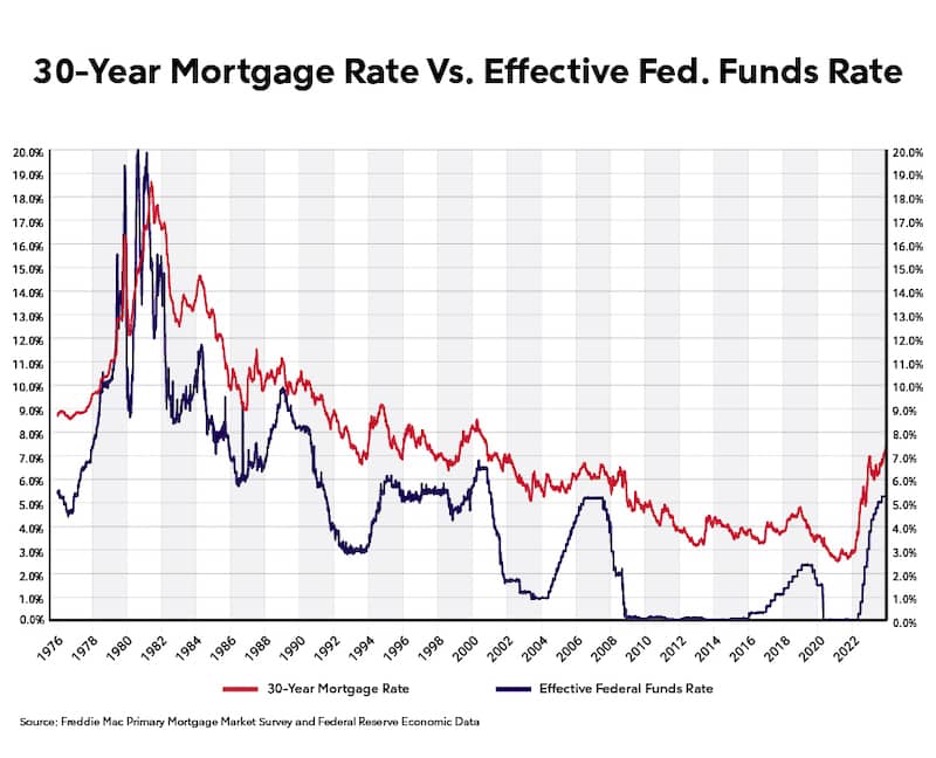

Since March 2022, the Fed has been on a persistent campaign to bring inflation under control. In order to do this, they’ve increased the target range for the federal funds rate 11 times. Whether they’re done for now is up for debate. However, the effect has been felt across the economy.

Because the Fed funds rate is the rate at which banks borrow from each other, when that rate goes up, interest rates rise across the economy, including those for mortgages. The effect is less drastically felt for mortgages than for credit cards because mortgages are longer-term loans but, over the past 2 years, 30-year fixed rates have more than doubled.

Additionally, during the pandemic, when the Federal Reserve was trying to keep mortgage rates low in order to stimulate the economy, they were focused on buying MBS. Because there was a big and consistent buyer, demand in MBS was high – pushing yields and rates lower. Now that the Fed isn’t an active buyer anymore and has been selling off its MBS portfolio, that’s one more thing that has contributed to mortgage rates moving higher.

Health Of The Economy

Beyond inflation, the Federal Reserve also must concern itself with the overall health of the economy, which comes down to the other half of the Federal Reserve’s mission: maintaining maximum employment.

One of the bigger indicators it looks at is weekly jobless claims. If these start to spike, it could be a sign that businesses are feeling the pinch of higher interest rates and downsizing their workforces.

Declining retail sales data might be a sign that what the Fed is doing has affected consumers enough that it led to a significant pullback in spending.

If the Federal Reserve gets concerned about either jobless claims or retail sales, it could decide to cut rates.

There are also external shocks to the system that could throw a wrench into the economy much more quickly than anything else.

Ongoing wars overseas have economic impacts both in the short and long term. Domestically, strikes across multiple industries from entertainment to auto workers and more can mean major decreases in income during the strike and a loss of overall spending. While some states may feel these economic effects more directly, over time it can influence economic performance nationwide.

Indicators To Watch

But how does the Fed track the economy and how could it give you some insight into where mortgage rates might be headed? Before we get there, let’s take a look at the one thing the Fed controls.

Federal Funds Rate

The federal funds rate is actually set in individual transactions when banks borrow from each other, but the Federal Reserve does set a target range.

The federal funds rate itself is the Fed’s primary tool for controlling inflation. When inflation is getting out of hand, they raise the target rate. When it seems like the economy is slowing down, the target gets lowered to stimulate growth.

When it’s more expensive for financial institutions to borrow money, that cost is directly passed on to the consumer. On the other hand, when the federal funds rate range is lowered, consumers benefit from lower rates and easier borrowing.

While the federal funds rate doesn’t drive mortgage rates, it does affect them. We’ve mapped the relationship between the federal funds rate and mortgage rates below.

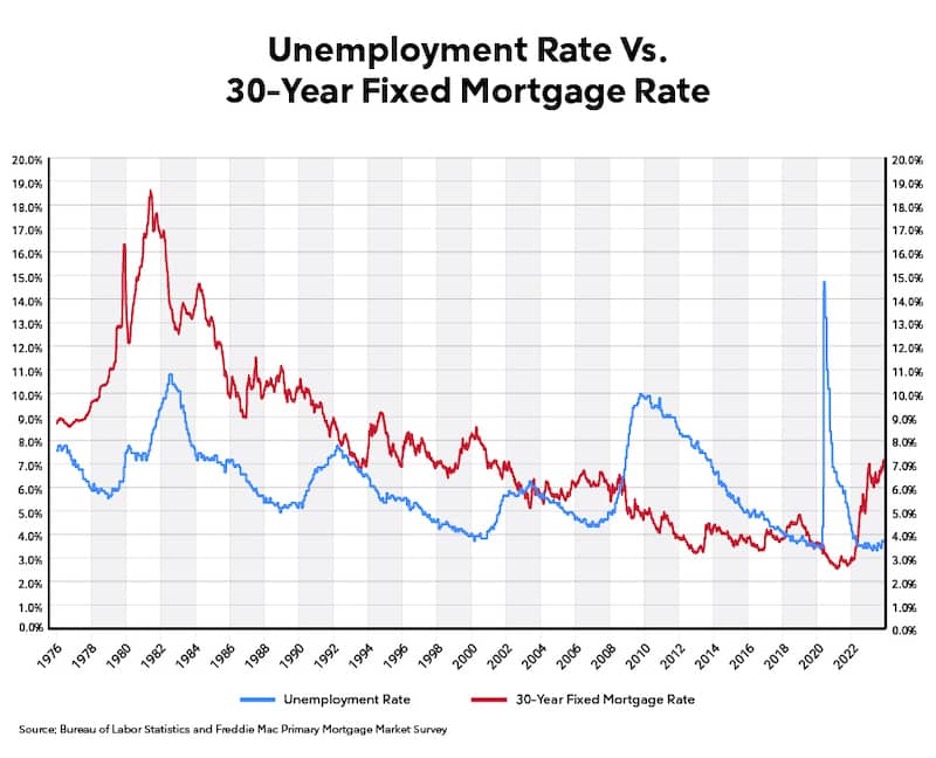

Unemployment

There’s no single number that signifies maximum employment. In fact, if you look at the average of the unemployment rate during a recession vs. when we aren’t in a recession, the difference in records going back to June 1976 is less than 1%. Does that mean that we don’t experience a significant difference in employment in a recession? No.

Rather, what’s happening now is that we have more people employed in recent years than we have at any point in history. The unemployment rate right now is 3.7%. In January and April of 2023, the unemployment rate hit 3.4%, the lowest that number has ever been.

The most commonly occurring unemployment rate in the data we looked at is 5.4%. The median rate is 5.8%. The point is, we are at abnormally low levels and it wasn’t so long ago that an unemployment rate of 5% was considered full employment.

Now we’ve somewhat reached a new normal. Think about all the shifts that have taken place in the economy within the last 10 years. Technological change, accelerated by the pandemic, created opportunities for remote work and an entirely new class of gig worker. That has reset expectations.

In the Federal Reserve’s latest economic projections, the median expectation is that in the long run, unemployment is likely to be 4%. But in addition to the unemployment rate, it can also be helpful to look at jobless claims.

As a recent example, we chose to look at the period from 2015 – January 2020. Although somewhat arbitrary, this represents a time when the economy should have sufficiently recovered from the recession from December 2007-June 2009, but before the pandemic hit in February 2020.

During this time, the average number of initial claims for unemployment was 243,699. The unemployment rate in January 2020 was also similar to what we have today, running at 3.6%.

It’s impossible to predict exactly when the Federal Reserve would likely be forced to act and drop rates as a result of higher unemployment claims or the unemployment rate itself. There’s a balancing act between a desire to control inflation and having maximum employment.

Again, unemployment rates do not drive mortgage rates but, if you look over time, mortgage rates usually fall in response to recessions.

Inflation

If the Federal Reserve feels that inflation is going to remain high, they end up raising the target for the federal funds rate to try to bring inflation down. As mentioned earlier, that could push mortgage rates up.

On the flipside, if prices are falling, the Federal Reserve could choose to lower interest rates on the assumption that people will be willing to spend more money, which stimulates the economy but can push prices higher. If people think prices are going to fall, they may wait to buy, which hurts production and employment.

Inflation is the #1 thing on the Fed’s radar right now. There are lots of reasons it’s currently higher than the Fed’s 2% target.

During the pandemic, there were supply chain disruptions, which meant prices were higher for many goods and services. Additionally, the government injected stimulus money into the economy, which gave people more money to spend.

One key the Fed is likely keeping an eye on is not only getting inflation down to its target but making sure wage growth is keeping up with. If it isn’t, people end up with decreased spending power even if they’re getting raises.

The Federal Reserve may not choose to lower the federal funds rate until inflation comes down to where they want to see it. They’re trying to do this without causing enough damage to the economy to start a recession.

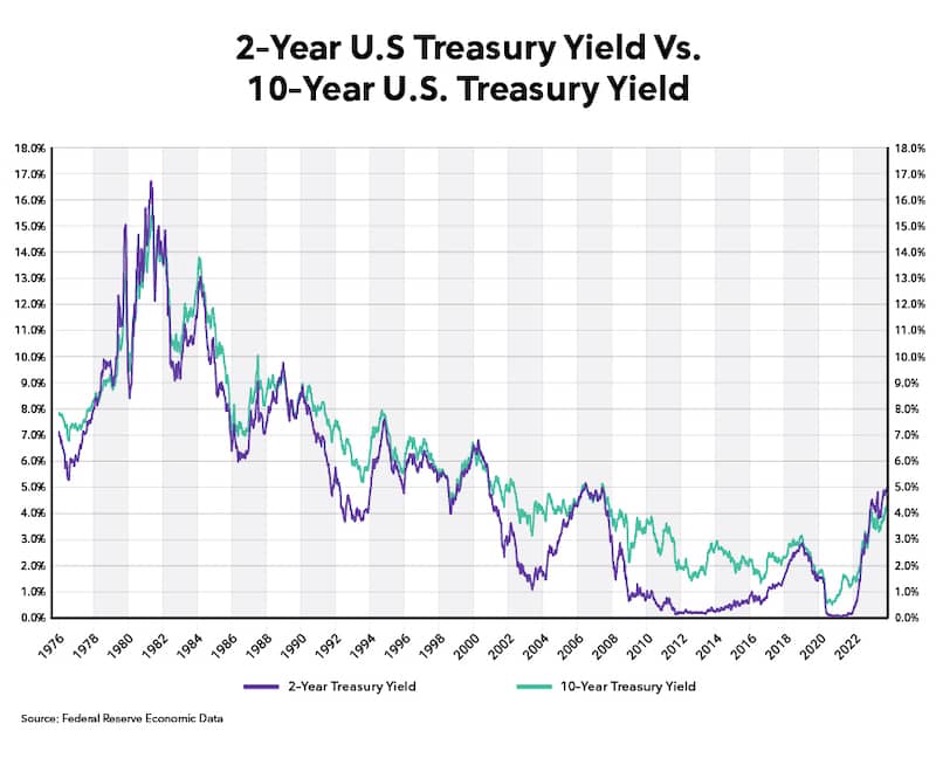

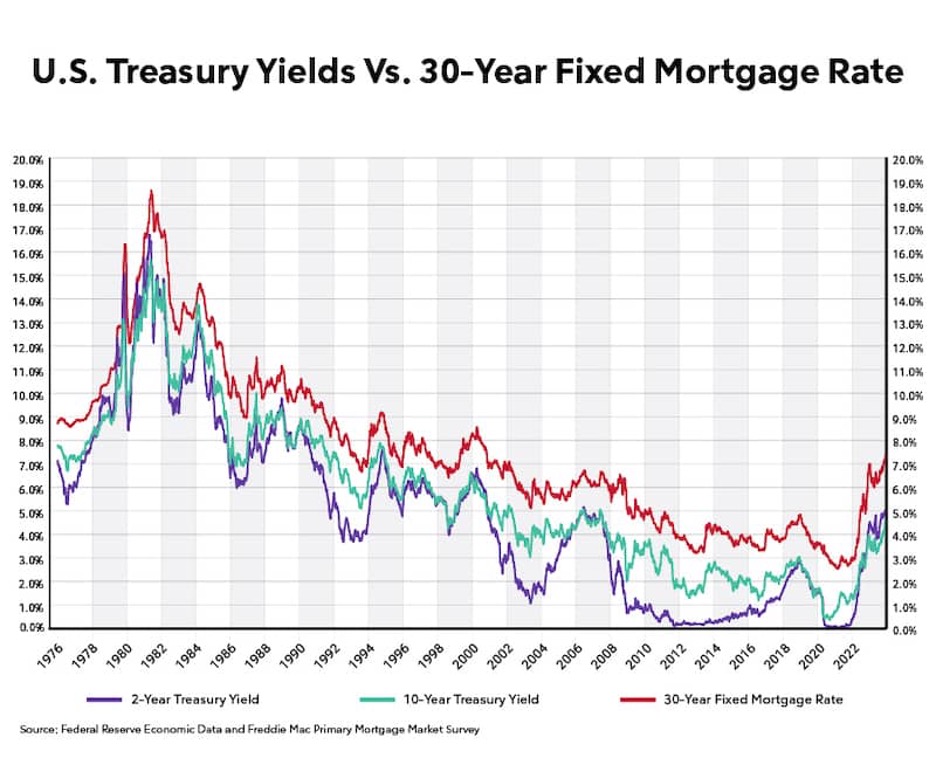

Treasury Yield Curves

Treasury bonds are used to fund government operations. The investor buys a bond that funds the government then, when the bond matures, they can cash in the bond for their original investment plus the interest rate determined by the yield.

In a healthy economy, longer-term bond yields are higher than shorter-term ones because the investor should get more interest for their money being tied up longer. However, bond yields are also determined by market demand. If people are buying a lot of 10-year bonds, the yield moves lower, meaning we can learn something about economic perception.

If people believe the economy is going to be worse in the short run, they start willingly tying their money up in longer-term bonds, which drives the yield down. If enough investors buy these bonds, the 2-year yield ends up higher than the 10-year yield. This is referred to as an inverted yield curve. The data shows that the U.S. often goes into a recession within about a year and a half.

Recessions are historically correlated with lower mortgage rates.

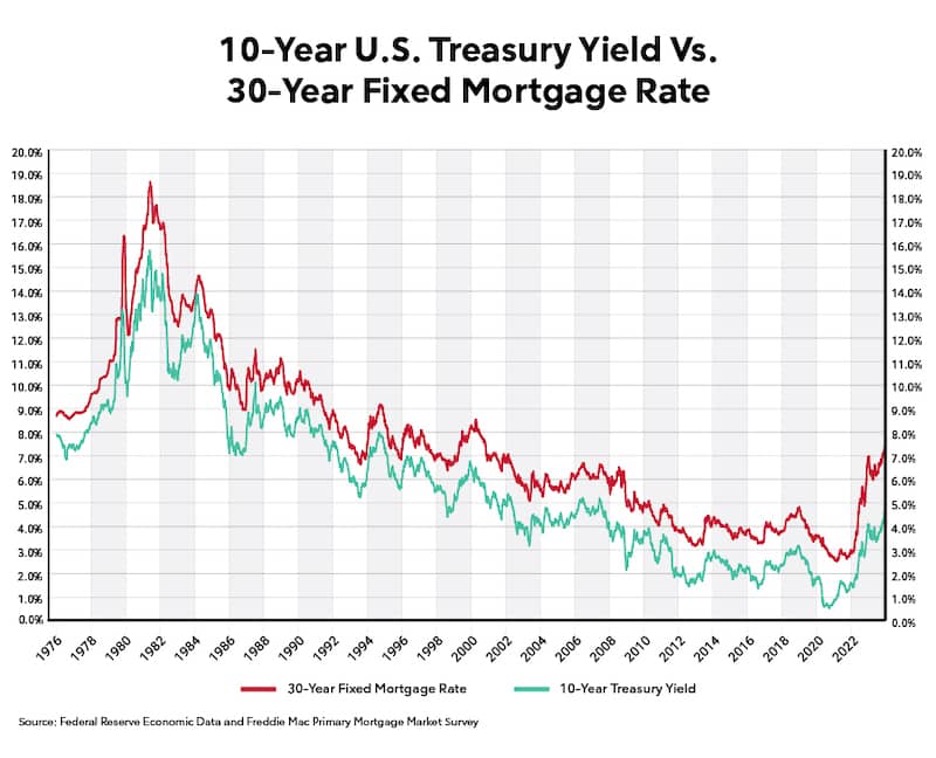

The direction of the 10-year Treasury yield tends to correlate with the 30-year fixed mortgage rate. You’ll find they go in the same general direction despite the fact that MBS and the treasury aren’t the same.

Historical Examples

This is all fine in theory, but what does it look like in practice? Let’s take a look at three examples from the 21st century.

Great Recession

During the Great Recession starting December 2007 and ending June 2009, the U.S. saw one of its deepest declines in economic activity since the Great Depression. Let’s look at how the patterns that we just talked about played out here.

First, the yield curve inverted on June 16, 2006, meaning investors were receiving a higher yield for buying 2-year treasury bonds than for those lasting 10 years.

By December 2007, recession had hit. The first thing noticed by most was probably an abrupt jump in the unemployment rate from 4.7% in November to 5% in December. By the end of the recession in June 2009, the unemployment rate had reached a peak of 9.5%.

The Federal Reserve cut rates 10 times until rates were effectively at zero. This was also the first time that the Federal Reserve chose to buy mortgage-backed securities in large quantities as part of a package of actions referred to as quantitative easing meant to make loans and credit more available to Americans.

So, what was the effect of the Great Recession on mortgage rates?

Just before the recession, the average 30-year fixed mortgage rate was 6.1%. Over the course of the recession, it fell to a range around 4.8%.

Brexit

There can also be expectations of certain things happening that are thrown off by international developments unrelated to any of the indicators we’ve talked about. Traders are human after all. They get scared like the rest of us.

By June 2016, the U.S. had basically recovered from the Great Recession. The Federal Reserve had begun taking the first steps toward unwinding some of the actions it took during the recession. At the same time, however, citizens in the UK voted unexpectedly to leave the European Union (EU). This became known as the British exit from the EU or simply “Brexit.”

In the weeks immediately following the vote, traders flocked to U.S. Treasuries and MBS like a comfort blankie. Yields on both the 10-year and 2-year Treasuries dropped, and mortgage rates experienced a temporary shift downward of 15 basis points (0.15%).

That doesn’t sound like a ton, but it is when you’re talking loan amounts necessary to buy a home. That could mean thousands of dollars in savings over 30 years.

COVID-19 Pandemic

COVID-19 changed our lives in many ways, but we’ll focus on the economic impact. It’s something that can’t be understated. Government shutdown orders meant that unemployment went from 3.5% in February 2020 to 14.7% in April.

The Federal Reserve quickly dropped interest rates and again pledged to buy significant amounts of MBS. The recession didn’t last long, but the impact on mortgage rates was felt for quite a while. The period at the end of 2020 and the beginning of 2021 saw some of the lowest rates ever, hitting an all-time low of 2.65% in early January 2021.

The Bottom Line

Time machines and crystal balls don’t exist, so anyone who says with certainty that they know what mortgage interest rates are going to be months or even a year from now is fooling themselves. There are way too many factors involved.

However, there are trend indicators that have shown when rates might rise or fall based on the effect of certain events on the economy throughout history. The Federal Reserve is focused on inflation levels right now. All things equal, they don’t want to drop rates before inflation comes down, but they have to balance their 2% target with not inflicting too much damage on the rest of the economy.

In addition to inflation, unemployment and treasury yield curves can also be good early indicators of recession, and future rate drops, particularly if the yield curve inverts. But it’s important to note that the world is unpredictable and events around the globe can also throw curveballs in any predictions.

This article was originally posted on RocketMortgage.com.