Rocket Fuel Newsletter – 03/04/2024

Is dynamic pricing coming soon to the Wendy’s menu? Whether it’s surge pricing during busier times or lower prices to encourage customers to buy targeted foods, just remember: words matter in advertising.

In this edition: big news for Rocket Pro TPO partners, the month’s review of major housing data and ‘Leaplings’ finally get a chance to celebrate their birthdays!

Fuel Up! 🚀

Credit Upgrade For All!

Did you hear? Credit Upgrade, our free rapid rescore program, is now available for all partners. Use it to qualify more clients and win more business!

Watch Fawaz’s announcement about this huge win for the broker community!

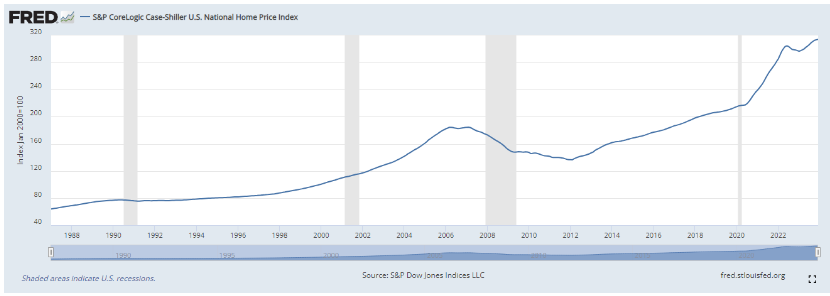

Home Prices Hit New All Time Highs

The Case-Shiller Home Price Index for December rose once again, continuing its hot streak. On a seasonally adjusted basis, the index has now set seven consecutive record highs and all 20 markets posted yearly gains. The annual gain for 2023 was 5.5% which demonstrates steady growth and exceeds that of the average annual home price gains in the last 35 years.

Inflation Comes In As Expected

The Personal Consumption Expenditure (PCE) index came in at 2.4% over a 12-month basis. This was in-line with expectations and eased some of the fears around inflation and bucking the trend of hotter than expected reports.

The expectation within the markets is now that inflation will come in-line with the 2% goal around mid-year; this is the Fed’s purported benchmark for when we could begin seeing rate cuts.

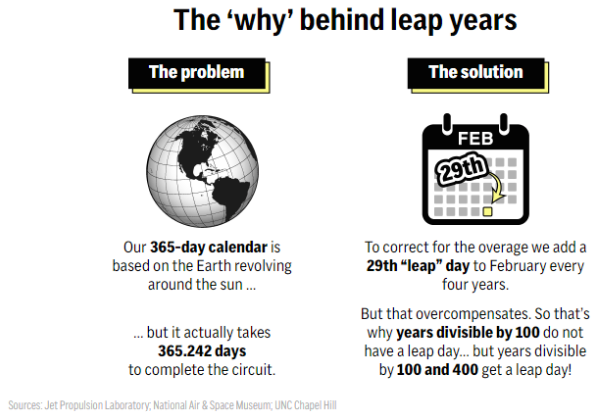

Leap Day Saves Our Seasons

What is Leap Day and what would happen without it? Unfortunately, the earth does not orbit the sun in precisely 365 days; it takes roughly 6 hours longer to complete the trip. While six hours may seem insignificant, stacked up over hundreds of years, our seasons would become completely out of whack.

Alexander Mignone, Plaza Home Loans

Tell us about the beginning of your career? What got you started?

I was waiting tables at a steakhouse in college. One of my goals in waiting tables at a nice restaurant was to network to get an internship.

I waited on the owner of a mortgage brokerage during a company Christmas dinner. When I handed him the check, I asked what he did. After telling me he owned a brokerage here in Charlotte, I asked if he needed an intern. He immediately extended a job invitation.

At the beginning of 2020, I worked as his assistant and learned about the business. I decided to get my license and close loans on my own throughout my senior year of college during the refinance boom.

Tell us about some of your biggest lessons you’ve learned in your tenure.

Relationships are essential to this business for success. Who you know triumphs what you know. This extends into all aspects of business.

What’s one thing you want to tackle this year? Personally, and professionally?

I want to build a social media presence on Instagram, LinkedIn, and Facebook. Not for leads, but to be a face of homebuyer education.

Personally, I want to buy my first investment property in the mountains of North Carolina.

What is one thing you want to learn this year?

I want to learn how to manage a team effectively. Being a great leader takes effective communication and guidance, but as a producing loan officer, this is time-consuming. I want to learn how to manage and produce at the same time.

What are you most excited about for the future?

A growing business and lower rates!

Why Rocket Pro℠ TPO?

Rocket provides the best communication and service out of all wholesale lenders on the market. When I have a problem with a loan, I know Rocket’s processes and teams will be able to resolve it quickly and efficiently.

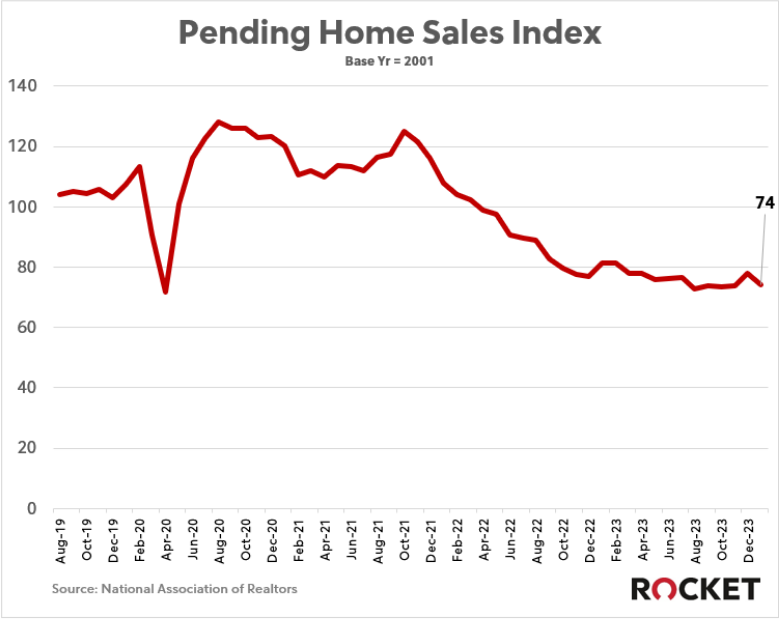

Something’s got to give – Prices or Rates?

After a surprising jump in December, economists expected that pending home sales (signed contracts for homes) would continue to increase in January.

Instead of growing 1.5%, they shrunk ~5%.

Another surprise to economists this week was the drop in consumer confidence.

Since the Fed began raising rates, consumer confidence has remained strong amidst a record setting spike in interest rates and persistent inflation in core consumer goods.

The stubbornly strong consumer is the reason people are finally coming around to the idea of a “soft landing” for the Federal Reserve’s interest rate policy.

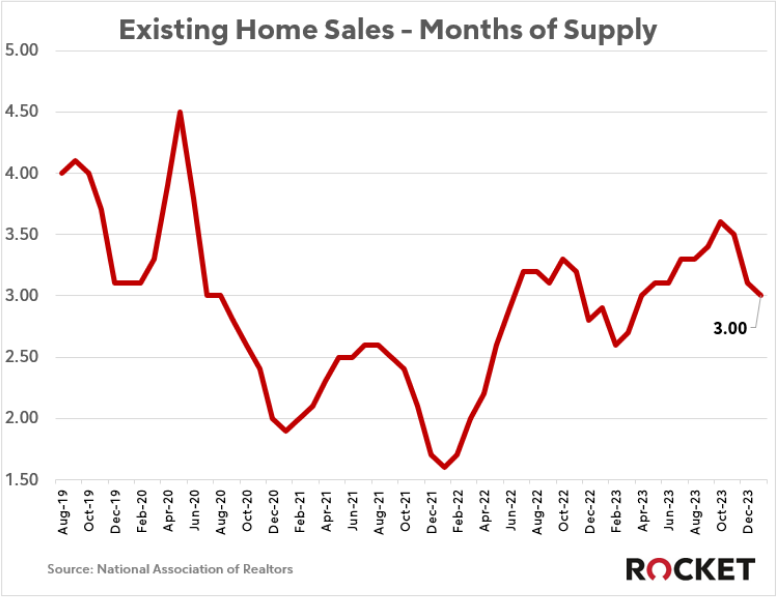

As we emerge from the supply and demand shocks of COVID-19, housing supply has begun to normalize.

Supply of existing homes still has a little more room to go, but with many homeowners feeling “locked-in” with rates so high, it’s likely that a drop in rates will free up some normal movement that creates supply.

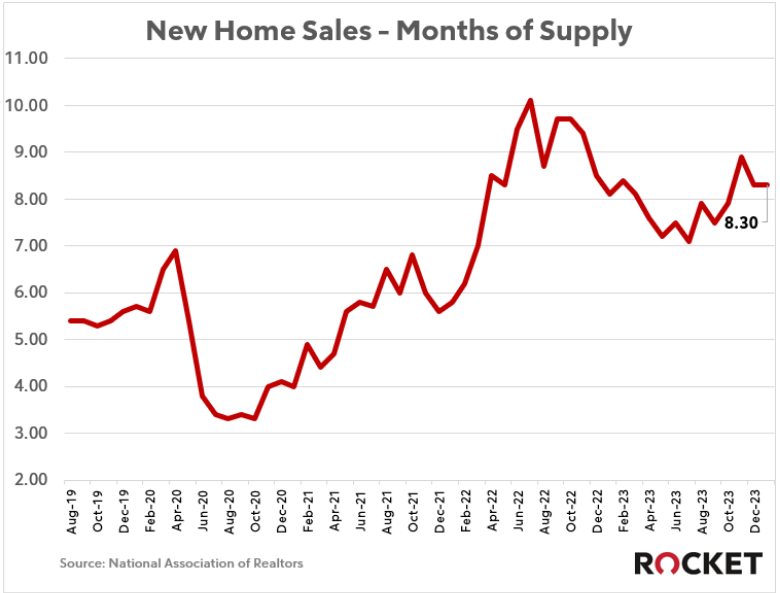

Builders have stepped up massively since the industry shrunk post-2008, and with supply chain issues having subsided, we’re seeing higher levels of supply for new homes.

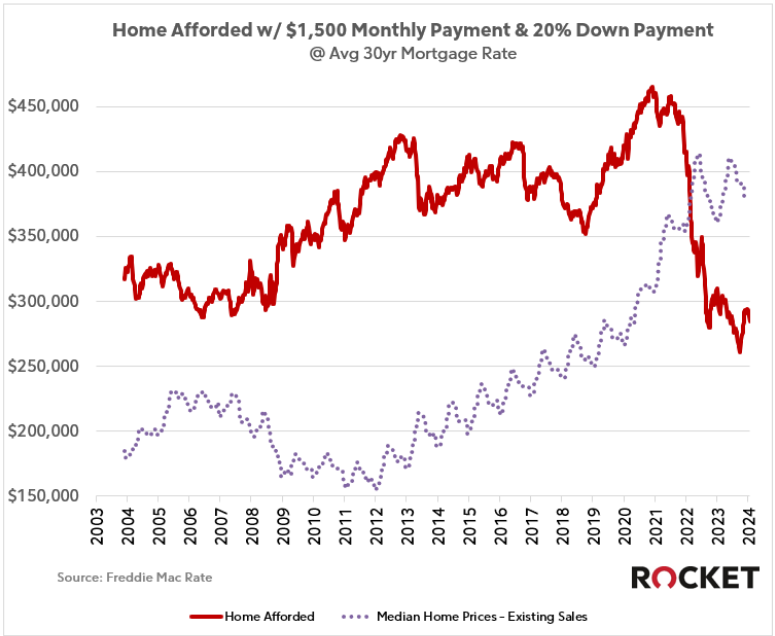

Home prices have continued to increase due mostly to low inventories as sales also remain low. However, there are also many anecdotes of builders shifting price cuts to financing in order to maintain the property values on their new builds.

This recent drop in pending sales matches up with an uptick in mortgage rates and a drop in MBA purchase apps, evidence of a hyper-sensitive consumer.

So, if rates don’t come down soon, prices gains might slow or reverse.

Fawaz and VP Don Chiesa joined our friends from West Capital Lending for a team event this week out in California!

Eleven seconds separated our top 4 solvers last week, and once again, Michael Bazavilvazo topped the charts with his time of 20 seconds. Congrats to Jim (26 seconds), Ali W. (30), and Mike C (31) for their great times too!

This week’s puzzle gets 5 Rockets out of 5.