Rocket Fuel Newsletter – 1/15/22

To all the Dogecoin HODL’rs out there – Elon isn’t giving up yet.

This week’s edition has inflation, Fed-speak and a battle between 30-year and 15-year mortgages

Fuel Up! 🚀

The Market

Market Moving Releases

- Jerome Powell kicks off second term as Fed Chair

- Consumer Price Index and Producer Price Index

- Retail Sales and Consumer Sentiment

The Big Picture With Bill George, Economist, Rocket ProSM TPO

If you want to know where interest rates are going to be in the future, it’s usually a good idea to listen to the people who set the benchmark rates – the Federal Reserve.

Chairman Jerome Powell was confirmed to his second term by Congress this week, and in his hearing, he shared his thoughts on where we’re headed this year.

To sum up his words:

- Inflation is the focus.

- Job growth is slowing, and participation is still lagging even as unemployment rates touch the 3’s again.

- A long expansion to reach maximum employment requires price stability – inflation is a threat to max employment.

The Fed will raise rates more than forecasts if need be. It's not 2020 anymore – It's time for a new normal.

Caffeinated Trends With Ryan Schoen, Senior Analyst, Rocket Mortgage SM

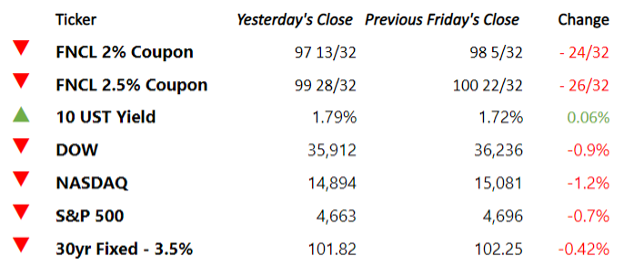

1. Spiking Mortgage Rates – This week, mortgage rates saw their largest weekly increase since March 19, 2020 around the time the pandemic sent shockwaves through the market.

This recent move places 30-year rates squarely back near pre-pandemic levels with 15-year rates lagging the quickened pace of rising rates. The 83-basis point spread is currently the widest since we hit 84 bps July 16, 2015.

Additionally, for the first time since January 17, 2019, 5-year adjustable-rate mortgages clocked in below that of the 15-year fixed loan option.

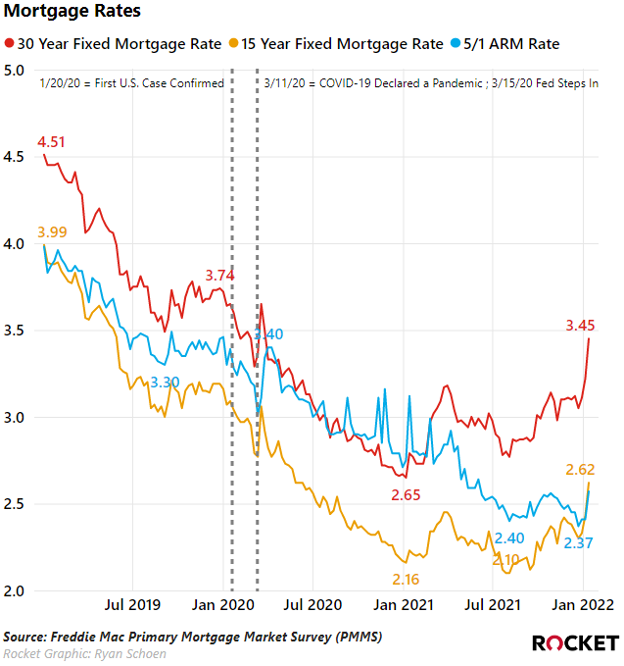

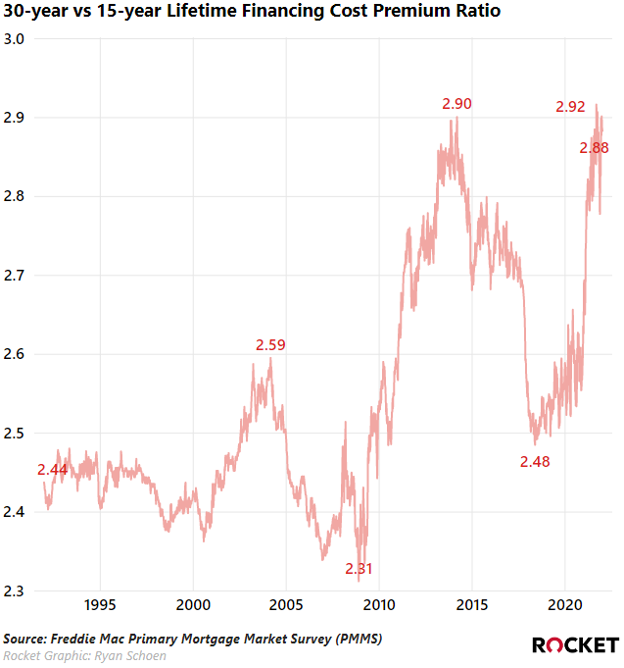

2. 30Y vs 15Y Mortgage Math 101 – To add color to these recent weekly average interest rates, we will go back to mortgage math 101 and visualize the accumulated principal and interest spent to pay off a loan over its life.

Using the $400k mortgage loan assumption below, we clearly see that spending $84k in interest is a better financial choice than spending $243k (assuming you can afford the higher monthly payment and do not have a better alternative use for your capital).

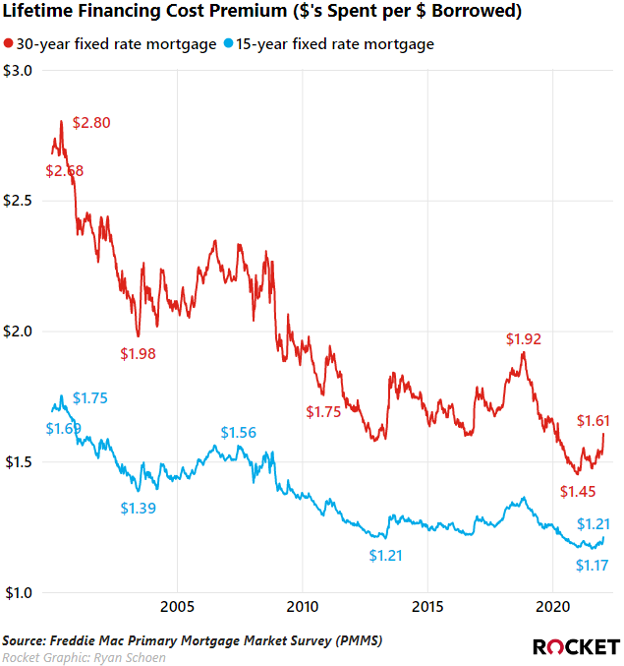

3. Simplifying Mortgage Options – While the amortization chart above is the typical go to for presenting current day loan options to clients, while also calling out that interest rates are near their historical low, what if there were a better way? Enter the chart below.

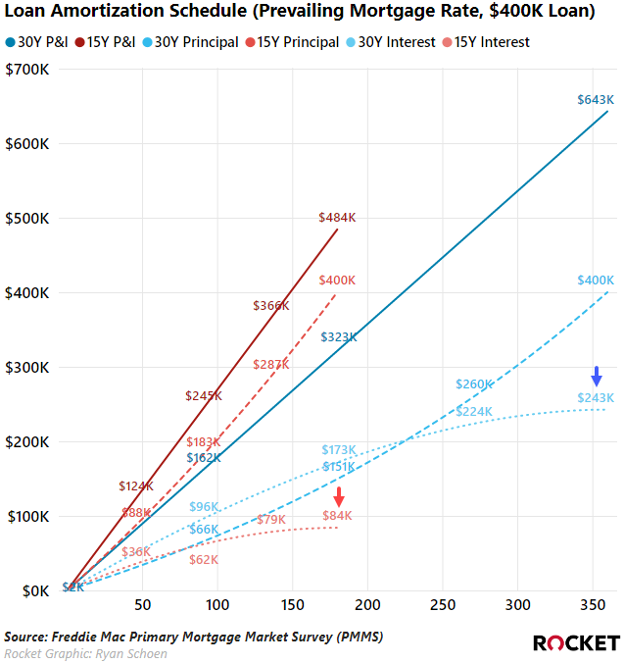

The lifetime financing cost premium chart tells us what the client can expect to payback over the life of the loan for every dollar they borrow.

The simple math from the $400k mortgage loan example above is this:

- 30-year: $400k x $1.61 = $644k

- 15-year: $400k x $1.21 = $484k

4. 15Y Looks Very Attractive – For those with a math mind, you are already likely playing around these numbers in your mind to explain to the client the benefits of a 15-year over a 30-year in an even more concise statement.

Well in that case, here is how to interpret things further. The interest the client can expect to pay for a 30-year mortgage is 2.9x (0.61 ÷ 0.21) that of the 15-year over the life of the loan.

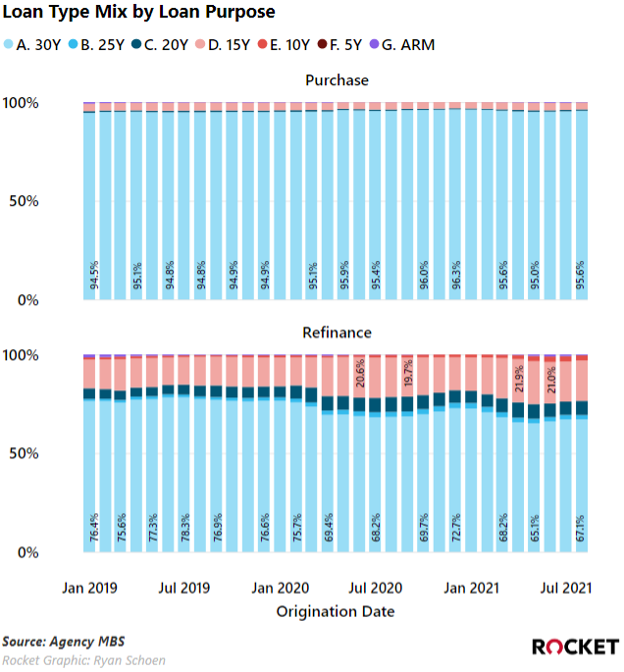

5. Loan Type Trends – The 30-year fixed-rate mortgage continues to underpin the U.S. housing finance market when purchasing a home regardless of the lifetime savings that a 15-year offers.

However, once homebuyers purchase their home, they leverage the 15-year mortgage with greater frequency. The post pandemic refinance boom boosted the use of 15-year product by ~8% (from 14.2% in January 2020 to 21.9% in April 2021 at its peak).

Partner Spotlight With Scott McMahon, Senior Analyst, Rocket Mortgage

America’s Moneyline, Inc.

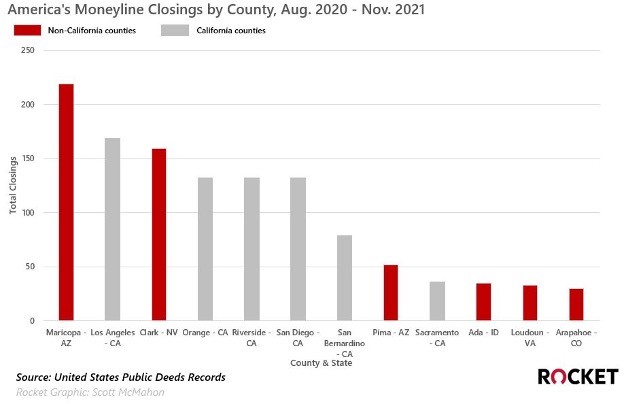

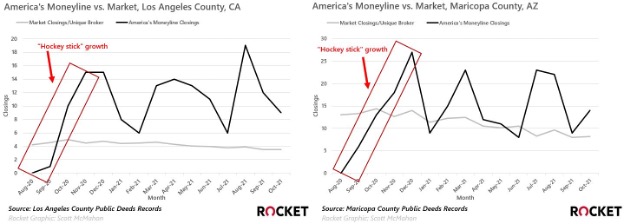

What’s your expansion strategy? Do you go big in your own backyard or try to build an empire across the entire country (or maybe a mixture of both)? America’s Moneyline, Inc., located in Alisa Viejo, CA, has experienced “hockey stick growth” since ramping up their mortgage business in 2020. Their rapid growth to close out 2020 turned into consistent production throughout 2021 as President Shawn Nevin and his team has executed a strategy of nationwide expansion.

“We’re already in 30 states, it gives us more opportunity,” Nevin said. “The more states you have, the more successful you are. I like states without as many brokers but with a good amount of people, and from there it’s a matter of being aggressive with my terms and my marketing to be as competitive as possible.”

So far, so good. Since summer 2020, America’s Moneyline has not only expanded to the aforementioned 30 states, but they’ve also found success where they’ve chosen to work. Of all the counties they’ve closed loans in since August 2020, 6 of their top 12 are counties outside the state of California.

Looking further into both Los Angeles County and Maricopa County shows that “hockey stick” growth that we love to see, followed by consistently outperforming the average broker in market wholesale closings in each area.

Fortunately, Rocket Pro TPO has been along for the ride since approving America’s Moneyline as a partner in October 2020. As their overall production transitioned from extreme growth to consistently high performance, their production with Rocket Pro TPO increased every month from February 2021 to August 2021.

“Rocket Pro TPO gives me the ability to execute and be precise; they’re fast, responsive, and there’s great communication,” Nevin said. “I use the Pricing Calculator to price out my loans, and I know that if I get stuck with something, I can escalate to an intelligent leader and they can resolve it.”

“[Rocket Pro TPO] is working as hard as I am, and I respect that. I’m very fortunate to have this relationship and I value it very much.”

America’s Moneyline, Inc., is proof that a nationwide expansion strategy can pay dividends; Shawn says if you’re looking to try it, make sure you’ve got a “laser beam approach” toward marketing.

“You’ve got to spend your marketing in the right place, and you need a laser beam approach to find out who can truly use your services in that area.”

--

Want to help brokers just like you take full advantage of their partnership with Rocket Pro TPO? Reach out to your Account Executive and you could be in a future Partner Spotlight!

What The Pros Are Reading

- Stearns Wholesale Closed Down By Guaranteed Rate

- Rate Lock Activity Falls For Fourth Consecutive Month; Rate/Term Refis Fall To Lowest Level In Two Years In December 2021

- Mortgage Credit Availability Increased In December 2021

- Softening Home Purchase Sentiment Index May Portend Slower Housing Market In 2022

- Generational Survey Reveals Affordability To Be Biggest Barrier To Homeownership

If you made it this far, you deserve a recap …

- Producer inflation continues to pose a risk.

- The U.S. and U.K. are leading the way in terms of reducing stimulus.

- Housing starts rebounded in December.

Pro Talks From Rocket Pro TPO

Have you signed up for Pro Talks yet? If you’re ready to enhance your negotiating skills and win more business, this one is for you!