Rocket Fuel Newsletter – 07/23/22

In this edition of Rocket Fuel, we talk about gas prices, lost luggage and the ongoing fight against inflation. Let's dig in.

Fuel Up! 🚀

Biz Buzz

Americans Buying Less Gas As Prices Remain High

Recent data has shown “fundamental changes” in how Americans have adjusted to higher gas prices – they've cut their miles.

Americans’ gas consumption has decreased by around 750,000 gallons per day as the price of gasoline has climbed nearly $1.50 per gallon from a year ago.

Other cost-saving measures have included working from home or buying a more fuel-efficient vehicle.

Flying Anytime Soon? Maybe Don’t Check Your Bag

Increased numbers of international travelers and a slow rehiring process following pandemic-driven layoffs have created a perfect storm of lost and undelivered baggage throughout the world.

Lost luggage claims have risen 67% year-over-year on U.S. airlines to 6 in 1,000 bags, and 24% worldwide to about 8.7 in 1,000 bags. That’s nothing compared to a baggage handling company hired by Qantas in Australia, who says the Qantas flights in Sydney lose 1 in 10!

Experts suggest buying tracking devices for luggage and taking photos of valuables for insurance claims if you must check a bag. Otherwise, pack lightly and carry your bag onboard until airlines hire and train new staff members.

Caffeinated Trends

Over the last few weeks, we’ve seen the market digest a 75 bps interest rate hike in the country’s base interest rate – the federal funds rate.

The Federal Reserve is trying to regain confidence and wrestle inflation down before it becomes fully embedded in the country’s psychology.

Housing/shelter makes up around 30% of the Consumer Price Index for inflation, so the ~40% growth in home prices over the last 2 years is certainly an inflation culprit.

Existing Home Sales came in weaker than the already lower expectations, signaling that the Fed’s higher rates have taken the wind out of the sales in the housing market.

The power dynamic is beginning to shift back toward home buyers in terms of price negotiation.

Buyers may remain hesitant as prices have jumped, and they fear a collapse like ‘08 – especially as their crypto and 401(k) portfolios have already entered a recession this year.

However, if home values follow the same pattern as the ‘70s/’80s inflation comparisons, home prices could hold their ground even as sales slow.

This means buyers are paying more than they would have during COVID, but they’re also beginning to have more choice and flexibility as those looking to sell have less liquidity and demand for their homes.

Partner Spotlight

With Ryan McCallister, President & Principal Broker, F5 Mortgage

Favorite vacation spot: “The Atlantis resort in the Bahamas. I went there as a little kid and it was mind-blowing.”

First job: “I worked at a worm farm. There was surprisingly a huge demand, so we’d have to ship in worms from Europe. We’d have to feed them, put them into cups, and then ship them out.”

Coffee preference: “Straight black coffee”

First concert: “Lil Wayne in 2009”

Famous local delicacy: “Traverse City cherries”

Favorite things about Rocket:

- Loan process: “It’s so much easier to register a loan with Rocket. … We can get it done in around 10 minutes from start to finish. And when I get a CTC from Rocket, I know it’ll close.”

- Technology: “The tech is second to none, and it couples well with our consultative approach.”

- Credit Upgrade: “We can get [the client] up to a better credit score. It can save them money, and then they’ll refer us to more people.”

“Trust the process” has become a common saying in recent years as words of encouragement for getting through times of change. For Ryan McCallister and his team at F5 Mortgage in Traverse City, MI, trusting the process has meant creating new procedures and adapting to new roles within the company, all for the sake of a better loan experience for both real estate agents and clients.

F5 – whose name comes from the keyboard shortcut for refreshing a webpage – began in late 2019 with the goal of combining the marketing/lead generation approach from the D2C mortgage space with the products and optionality that the wholesale market offers. Ryan and his team realized early on that while the intentions were there, they didn’t yet have the systems needed to fully execute on their goal.

“We didn’t have [standard operating procedures] when we started, it was just kind of a mess and led to unnecessary delays and a poor client experience.”

As the pandemic began in 2020, F5 began implementing new procedures and roles within the company that have ultimately led to their success today as one of the largest wholesale lenders in the state of Michigan.

Consultative Approach

Ryan’s shift away from a more standard sales approach was tested during the pandemic when the refi boom took off.

“Everyone qualified for a rate/term refi, but rather than slamming as many loans through the process as possible, we went for a more consultative approach – going over the credit report, finding opportunities for the client to save more, and suggesting what they could do. We became consultants more than LOs.”

Now that the pandemic-fueled refi boom has subsided, Ryan and his team are back to their bread and butter – purchase loans – which Ryan believes fits perfectly into his team’s skillset.

“We’re excited to get back to the relationship building. It pairs nicely with our consultative approach, almost like a financial advisor. We’re making sure we’re structuring the loan in a responsible way for the client.”

State Licenses

As they have grown their team, Ryan has also expanded F5’s reach to 11 states, from Washington to Florida.

“We knew low rates wouldn’t last forever. Being a growing company, we wanted to make sure we had as much opportunity as possible.

In addition, Ryan called out the merits of using a third-party licensing system to manage his Loan Officers’ state licenses. Since each state has their own rules and regulations around licensing, Ryan suggests partnering with one of these third-party companies to avoid licensing becoming a full-time job for a broker president.

Account Managers

F5 has created the Account Manager position, which is responsible for being the only point of contact between real estate agents and the F5 team. Ryan cites past feedback from agents of “too many cooks in the kitchen,” so the Account Manager role was F5’s way of creating a better experience for both the real estate agent and client.

--

As with most organizations, structure, systems and accountability are critical for a mortgage broker to survive, and Ryan is thankful that he and his team were able to trust the process and impact the outcome with the people for whom it matters most.

“It’s all about not losing sight of what matters most – the client experience. The more you can systemize, the easier it becomes to scale. There’s also more accountability, and that makes the business that much better.”

In The Weeds Reads

Pro Puzzles

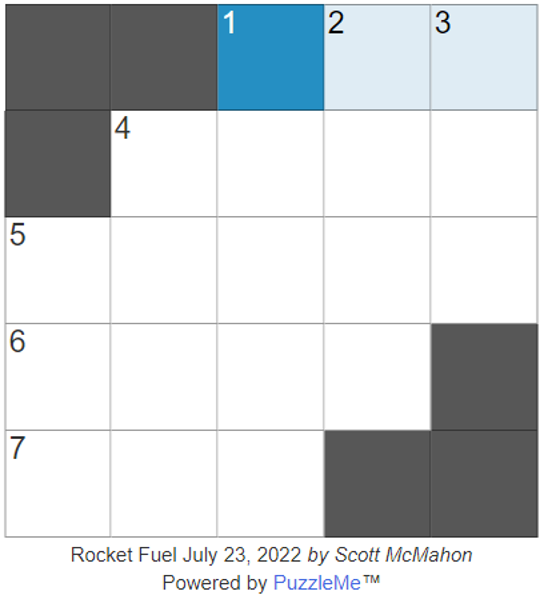

Tough puzzle last week! Out of the hundreds who gave it a shot, Alex B came out on top with a time of 2:27. In fact, Alex was the only person under 3 minutes – well done!

This week’s puzzle is back to a 5x5 grid and gets 2 Rockets out of 5.