Rocket Fuel Newsletter – 07/01/23

Joey Chestnut consumed over 18,000 calories from 63 hot dogs and buns in 10 minutes last year – see how investment firms are doing their best Chestnut impression by gobbling up housing inventory like it’s a Fourth of July barbecue.

Fuel Up! 🚀

Bow Tie Day At The Rocket Mortgage Classic

In memory of Nick Gilbert, Rocket Companies chairman Dan Gilbert’s 26-year-old son who passed away this May, Thursday’s first round of the Rocket Mortgage Classic was named Bow Tie Day, commemorating the iconic accessory that Nick wore in his appearances at the NBA Draft Lottery.

Proceeds from Bow Tie Day went directly to the Gilbert Family Foundation in their efforts to find a cure for neurofibromatosis (NF) type 1, which Nick battled his whole life.

Fed Chairman Gives Update On Inflation Goals

In a panel discussion at an event in Portugal, Federal Reserve Chairman Jerome Powell suggested it may be a while until we see inflation fall to the magic 2% mark.

Traveling For The Holiday? You’re Not Alone

Don’t expect short security lines at the airport or empty highways on the road over the Fourth of July – AAA anticipates record numbers of travelers this holiday weekend!

Victoria Viorde, TPG Mortgage

- What is one thing you wish you knew when you got started?

- There is so much to learn and so much to know [that] you must be patient with yourself and the process. You will be learning new things every day so be sure to utilize all the resources available to you, but do not get overwhelmed with information because learning is an ongoing process that does not stop.

- What’s your favorite thing about being in this industry?

- My favorite thing is the joy of knowing I contributed to the client purchasing a home, whether it’s [the excitement of] their very first home or, recently, I just closed a loan in April for a client making his first investment purchase. That was a dream for this client, to get a portfolio started – and going to that closing, feeling that excitement in the room!

- What are you most excited about for the future?

- I am most excited about the growth of TPG Mortgage and how I am going to evolve [personally] in this industry.

- Why Rocket Pro TPO?

- I love love love the “Simplicity is genius” ISM. It aligns with my belief that things should be kept as simple as possible because that leads to efficiency. That shows with Rocket Pro TPO’s system and technology compared to other systems where there is so much information I do not even know where to start.

- What is your “why”?

- To help people. That is as simple as I can be, and it comes from the heart – just the feeling of helping someone.

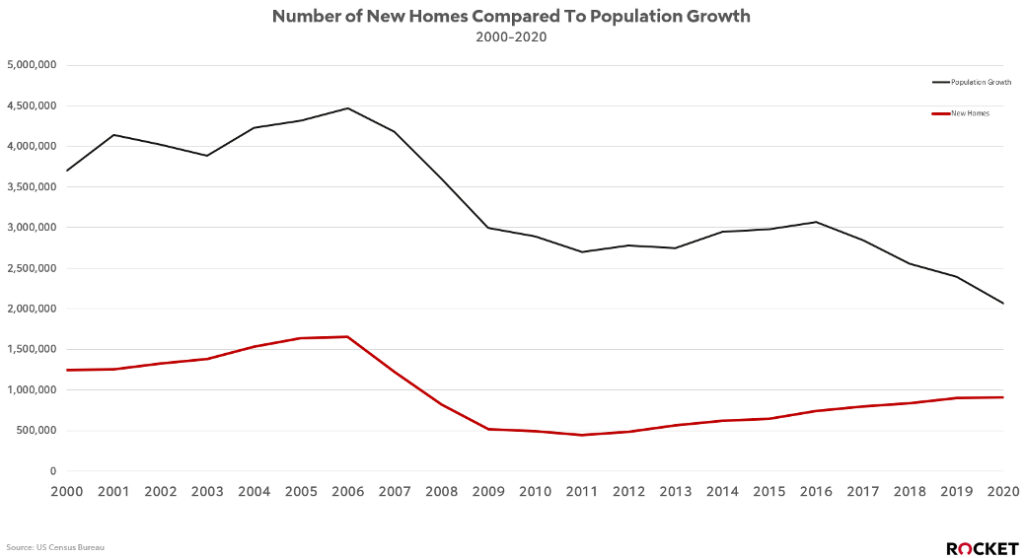

It is a challenging time to buy a house, especially for first-time home buyers. Low housing inventory has plagued those in search of buying a house for years. Since 2000, population growth has outpaced the construction of new homes and has created a strain on the supply of homes on the market.

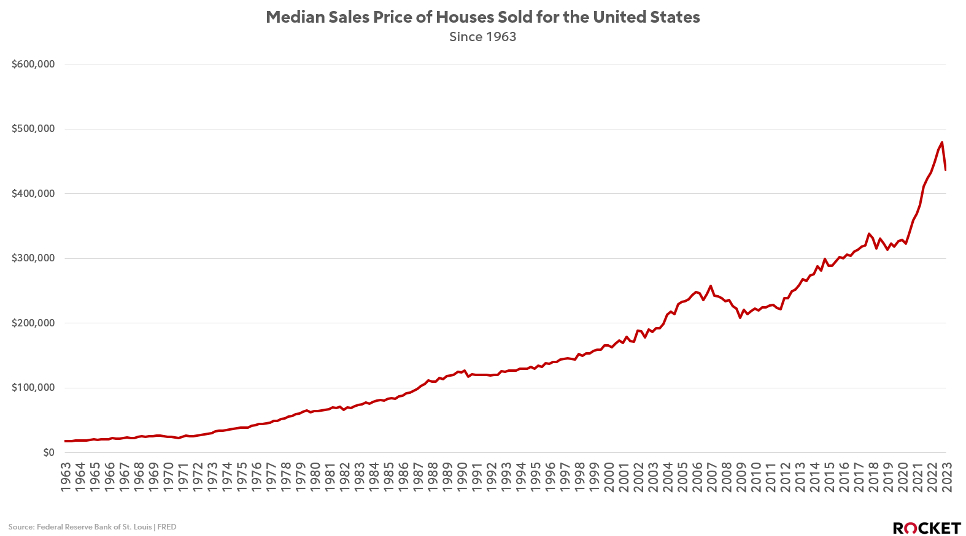

The lack of inventory has caused the median sales price of houses to rise drastically. Currently, the median price of houses sold is above $400,000, which is up over 40% from the start of the COVID-19 pandemic.

Coupling these higher home prices with higher interest rates, many buyers across the nation are being priced out of their respective markets. At current interest rates, the average monthly payment for the median home sold is around $3,000, nearly double what it was in 2019. To afford a home in this range, one would need an average salary of $105,000. According to a recent analysis of real estate listings by the National Association of Realtors, a person that makes $75,000 per year would only be able to afford 23% of homes on the market. To make matters worse, most of the competition is found on homes in this price range, which adds to the difficulty of buying.

Unfortunately for buyers, housing affordability could get worse before it gets better. At last week’s meeting, the Fed signaled that future rate hikes are likely, and the Fed is now projected to raise interest rates again this year. This would put even more strain on the pockets of buyers if home prices do not come down.

One other factor that is influencing the supply of homes and their affordability is large investment firms. Companies like Blackstone have begun to realize the potential of buying single family homes and renting them out. The deep pockets of these institutions are often too much for the average buyer to compete against, and they have allowed these institutions to acquire significant amounts of property.

These firms are targeting markets where they believe to be the most opportunity to rent out homes and get a return on their money. For example, 28% of the residential home purchases in Texas in 2021 were from institution buyers.

The involvement of institutional buyers is expected to go up as well, and it is projected that by 2030, they could make up 40% of the market.

One solution to the affordability crunch is the construction of new homes. Homebuilders are working overtime to meet demand, and we are starting to see signs of progress. In May, single family homebuilding projects increased by the largest amount in more than three decades and permits for future projects also increased. Additionally, regulation has started to be discussed around institutions and their involvement in the single-family market. If meaningful regulation is passed, it will remove some of the competition from the market and help with overall affordability.

While it might take a while for housing to become more affordable nationwide, there are some markets where buyers are starting to gain the upper hand. Read the full analysis here and see if you’re in a unique environment to help your purchase clients!

The Next IGNITE Live is Scheduled:

Tuesday, July 11, at 2:00 p.m. ET!

Tune in and discover important offerings that can make a difference for your business!

Hey Fawaz! 👋 Can you talk to me about Condo Simply?!

- S&P Corelogic Case Schiller Index (April Home Prices On The Rise)

- FHFA April Housing Price Index Up From Last Year

- HUD New Residential Sales May Report

- Air Quality Plummets, What The EPA Says On How To Improve It Indoors

- 3-D Printed Homes Only Take 4 Days To Build

Five solvers finished last week’s puzzle in less than a minute, and another 10 did so in less than two minutes. Congrats to Ali, whose 24-second time just beat Josh Wescott’s time of 27 seconds.

Enjoy this super-sized puzzle for the big weekend. In honor of the Rocket Mortgage Classic, we’ll call this one a par 4 (4 out of 5 Rockets). Click here to solve!