Rocket Fuel Newsletter – 05/20/23

Will a deal be reached on the debt ceiling? With the risk of a major recession looming, this Florida professor may have picked the right time to challenge the record for longest time spent living underwater.

Fuel Up! 🚀

Fawaz Has BIG News!

Join him for a special, short IGNITE Live on Monday at 11:00 a.m. ET.

Sign up now!

Existing Home Sales Dip In April

Data released this week from the National Association of REALTORS showed a 3.4% decline from March to April and a staggering 23.2% dip from April 2022. Experts blame a number of factors, from high prices to limited inventory due to incredible interest rates that homeowners don’t want to give up.

How About An Interest Rate Of 97%?!

Soaring inflation up to 109% has caused Argentina’s central bank to raise the country's base interest rate to 97%. Cost of living has jumped 31% since January, putting enormous pressure on Argentine economists to quickly right the ship for Latin America’s third largest economy.

Hey Fawaz! 👋 What's Rocket ProSM TPO reason #4?!

Vittorio Sbrocca (left) & Nico Gianakopoulos, First Team Lending

- What is one thing you wish you knew when you got started?

- You do not need to know it all and you never will know it all when it comes to mortgages. At some point in your career, you will come across something you do not know.

- What’s your favorite thing about being in this industry?

- I love how hot mortgage topics are in the U.S. right now; everyone seems to have mortgage questions right now. I love the collaboration aspect of what it takes to originate a mortgage. Being able to work with such great third-party companies and lenders as Rocket Pro TPO makes my job that much easier.

- What is something you are incredibly proud of within your business?

- We are proud of how well we have done as a company during these slower times in our industry. We started as a purchase shop in a refi boom and everyone thought we were crazy. Starting out purchase- and relationship-focused helped us weather the storm that came over the past few years and I couldn’t be prouder of how we have handled this market.

- How do you want to grow your business?

- Organically, we want to grow from within and help those in our community.

- How would you describe your brand?

- A boutique lending experience for our clients that provides the personal touch of a local brand and the technology of the #1 lender in the country.

- Why Rocket ProSM TPO?

- The commitment to brokers during tough times is what really sets Rocket Pro TPO apart from its competitors. They have enabled us to grow during tough times and this is something that will not be forgotten.

What is the debt ceiling?

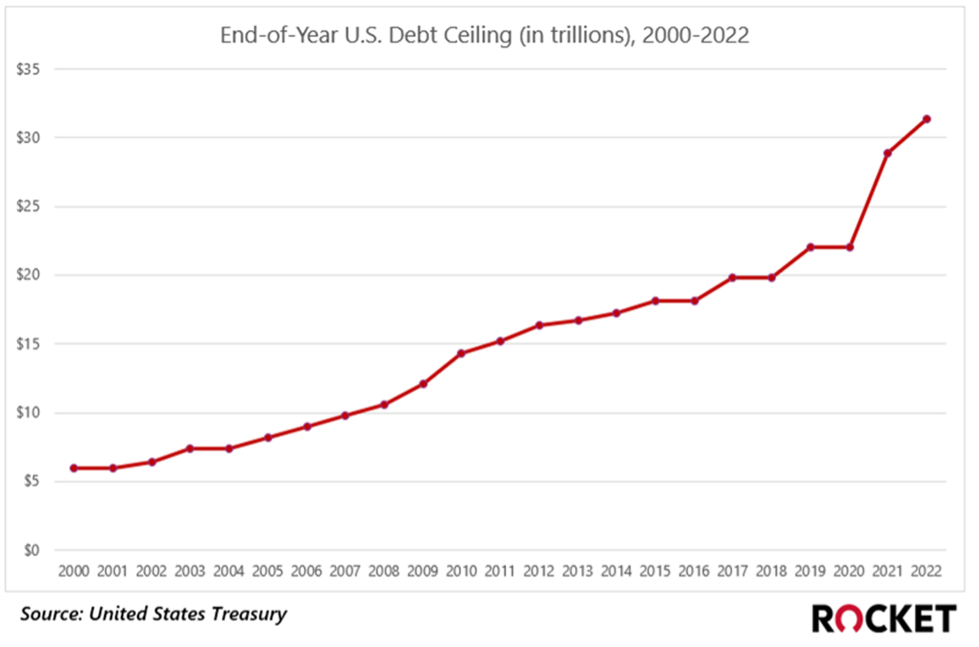

Simply put, it’s the nation’s credit limit. Since it was last raised in 2021, the government can only borrow up to $31.4 trillion. The U.S. hit that limit this January, prompting extraordinary measures to bridge the government until June 1 when Treasury Secretary Janet Yellen warned the country will no longer be able to pay its bills.

Check your calendars – that’s just a couple of weeks away.

Since its inception during World War I, the ceiling has been raised 78 times in usually fairly routine votes. The ceiling has been raised during war and during peace, under Republican presidents and Democratic presidents; however, with hyper-partisanship ruling Washington and unique in-fighting among Republicans in the House, this debt ceiling conversation is getting very interesting very quickly.

What are the options for a deal?

Obviously President Biden and Speaker McCarthy want to reach an agreement, but McCarthy has a lot more at stake than just the debt ceiling.

Option 1: McCarthy Appeases The Majority Of Republicans

This likely would have happened already had McCarthy not made it exceptionally easy for a group of about 20 hardline Republicans to potentially oust him from the speakership in order to gain the job in the first place.

It now takes just one House member to call a snap vote to potentially oust McCarthy, which would then only need a simple majority to pass. Assuming Democrats would vote to oust the Speaker, it would then just take five of the 20 hardliners to vote for his ouster.

TL;DR: McCarthy is calling his Republican opponents’ bluff by choosing this option.

Option 2: McCarthy Appeases The Hardline Republicans

This group of 20 representatives wants any bill that raises the debt ceiling to also include strict work requirements for programs like Medicaid as well as discretionary funding cuts that will span the next decade.

Passing a bill with substantial funding cuts would be a fool’s errand, as neither the Senate (controlled by Democrats) nor President Biden would support the bill. Plus, appeasing this small group would put significant power into the hands of fewer than two dozen representatives, which would not sit well with the general public.

TL;DR: McCarthy proves his loyalty to the people who effectively control his job, but delivers a bill that won’t pass.

Option 3: House Majority Circumvents McCarthy

While the Speaker typically controls the House agenda, the House can circumvent the Speaker by having a majority of representatives vote to bring a bill to vote on the floor. If there is a deal in place that Democrats and enough Republicans want to vote on, but that McCarthy refuses to bring to a vote (in order to satisfy the hardliners), that majority can bring it to the floor.

To the media, McCarthy would likely slam this tactic, as it’s an affront to his position as Speaker. Behind closed doors, though, McCarthy would likely appreciate having the decision taken out of his hands.

TL;DR: McCarthy’s favorite option, though it’s probably a longshot.

What happens if there’s no deal?

If there’s no deal prior to June 1, the U.S. defaults on its debt. Like an individual’s credit rating when they default, the nation’s credit rating would tank, which would devalue the bonds that the U.S. government has issued to investors and other countries as a way to pay its debts.

This would create a domino effect that would almost certainly result in a major recession and a global economic catastrophe, as one of the world’s largest economies would have essentially run out of money.

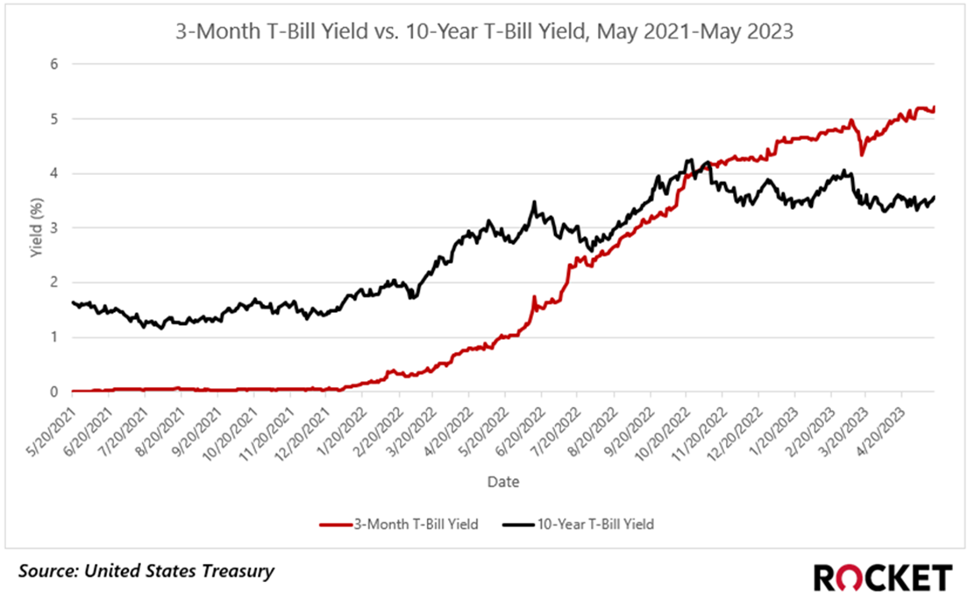

Already we’re seeing movement in the markets, as investors are increasingly hesitant to buy short-term Treasury bills.

The yield on 3-month T-bills has spiked over the past few months, implying less demand in these short-term investments, likely due to increased uncertainty over whether the U.S. government will actually be able to pay the investors back when the bonds mature.

Meanwhile, the 10-year yield has not fluctuated much since the general sentiment is that even in the event of a global economic catastrophe, the situation should have enough time to sort out before those bonds mature.

Divisional Vice President Jeremy Bednarz-Gray and Crew Director Jeanette Sapielak made their way down to BlueGrey Mortgage in Tampa, Florida, this week. Thanks for the warm hospitality!

- Single-Family Building Permits At 7-Month High

- HUD | Home Equity Conversion Process Expedited

- Census April 2023 | New Construction Report

- Read The National Association of REALTORS’ April Existing Home Sales Report

It's Time To Cash In On Cash Out!

Pass along a 25 bps LLPA credit on FHA cash-out refinances now through June 4!

Plus! New debt consolidation options for non-Rocket serviced FHA clients with 580 – 619 FICO® Scores.1

Congrats to the hundreds of solvers who completed last week’s puzzle! Our best time was Josh Wescott’s 17 seconds – he was one of just four to finish in less than a minute.

This week’s puzzle gets 4 out of 5 Rockets. Click here to solve!

1Client will receive 25 BPS off current pricing if their loan application was registered and locked through the Rocket Mortgage TPO Portal. Rate must be locked between 11:00 a.m. ET on May 8, 2023, and 11:59 p.m. ET on June 4, 2023. Offer valid only on FHA cash-out refinance loans. This offer cannot be retroactively applied to previously closed loans or previously locked loans. Non-Rocket serviced clients with FICO scores between 580-619 may use a cash-out transaction for the sole purpose of pay off debts at closing. Clients with 580-619 FICO scores may not receive greater than $500 in cash back at closing. Offer is subject to change at the sole discretion of Rocket Mortgage. Offer may not be redeemed for cash or credit, and no change will be given if the discount amount exceeds costs otherwise due. Offer is nontransferable. Additional conditions may apply. Not valid with any other discounts or promotions.