Rocket Fuel Newsletter – 04/29/23

Chocolatiers have built a replica bust of King Charles out of nearly 3,000 chocolates for the king’s coronation on May 6. What’s the bigger risk, the bust melting or a half-asleep late-night fridge raid?

In this edition, new Fannie Mae LLPA myths debunked, NFL draft picks making bank and a busy week for the economic calendar.

Fuel Up! 🚀

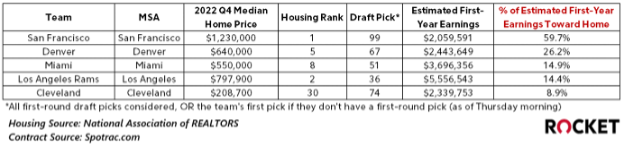

Purchase Power For NFL Draft Picks

The NFL draft began Thursday, and according to Spotrac.com, the Carolina Panthers’ first overall pick will stand to make over $30M between his signing bonus (~$27M) and his first year’s salary (~$3.5M). If their selection were to buy the average home in the Charlotte area ($395,500), that would eat up just 1.3% of his projected first-year earnings.

With that in mind, which picks would spend the least and greatest percentage of their first-year earnings on the average home in their MSA?

For the second straight year, Detroit’s first pick would spend the smallest percentage of his first-year earnings on a home – just 1.1% of his projected $21.9M would go toward the average home price of $237,000.

On the other side, San Francisco’s first pick (as of Thursday morning) is pick 99, which comes with a substantially smaller signing bonus and annual salary. As a result, almost 60% of that pick’s projected first-year earnings would be eaten up by the $1.23M average home price in the San Francisco MSA.

Economic Calendar Rundown

- The Case-Shiller home price index unexpectedly rose 0.2% in February, breaking the index’s 7-month streak of decreasing home prices.

- As mortgage rates dipped, new home sales boomed in March, up 9.6% from February versus the expected 1.1% decline.

- While new home sales flourished, pending home contracts on existing homes tanked, dropping 5.2% in March as inventory levels impeded sales activity.

Hey Fawaz! 👋 What's Rocket ProSM TPO’s reason #1?!

Monya Ehirim, Express Loan Process, Inc.

Tell us about some of your biggest lessons you’ve learned in your tenure.

One of the biggest lessons I’ve learned is to always follow a quality control process. Don’t take shortcuts. Every time I’ve taken a shortcut, it comes back to bite me. Invest the time to do things right up front and save yourself the hassle later on. The last thing you want is to take the easy way and have it cost your borrower their dream home down the road.

What is one thing you wish you knew when you got started?

I wish I knew how important it is to educate the borrowers on the front end and not assume that something that is common sense to me is common sense to everyone. For instance, assuming they know not to change their job or trade in their car in the middle of the application process.

I also think it serves loan officers really well to educate their realtors; it makes them more comfortable with you. When they are comfortable with you, it will ultimately earn you more business down the road as well because realtors and borrowers want to work with someone they trust.

What are some of your goals?

Personally, I want to be the greatest mom ever!

Professionally, I want to expand my business. I’m a small shop, it’s just me and my processor. I really want to bring on board loan officers who have the same type of vision that I do so that we can help as many people become homeowners as possible.

What is one thing you want to learn this year?

Streamlines and IRRRLs. A lot of people think they’re so easy and I want to understand them better. I think a lot of borrowers are going to start doing these streamlines in the next couple of years because many buyers are taking advantage of FHA loans right now.

Marketing. If I want to help as many people as possible buy homes, they have to know I’m here!

What is your “why”?

This is a real passion for me; I do this every day because I want to help everyone get their own piece of sunshine.

My first home purchase, I was in my late 20’s, and I didn’t know what I didn’t know. Now that I’m in the business, I see all the things I did wrong and I see where people had an opportunity to educate me.

I would really like to bridge the gap and help people understand that if you have a dream of homeownership, you can achieve it. Maybe not right this moment, but I will give them a plan and encourage them to work that plan so they can come back to me and achieve that dream.

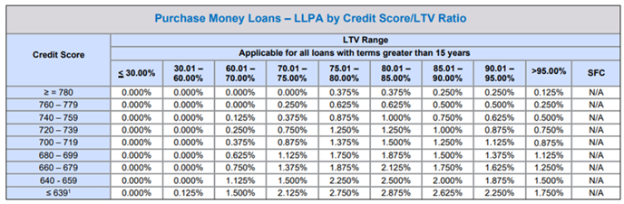

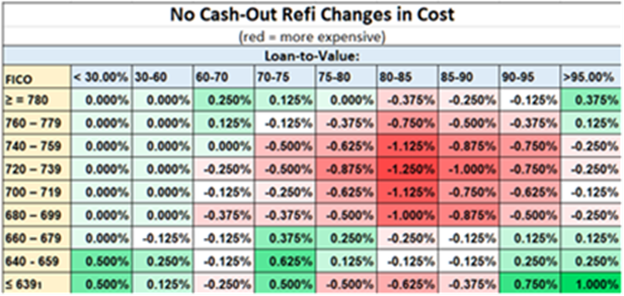

Earlier this year, Fannie Mae announced changes to loan level pricing adjustments (LLPAs). An LLPA is a risk-based pricing adjustment applied by Fannie Mae based on certain loan-level characteristics such as loan purpose, product types, credit score or loan-to-value (LTV) ratio. The new fee structure affects loans delivered on or after May 1st, 2023. Lenders have begun to implement these changes, which has started to generate noise in the industry. As shown in the figure below, the new LLPAs will still be significantly better for clients with higher credit scores.

New LLPA Fee Matrix

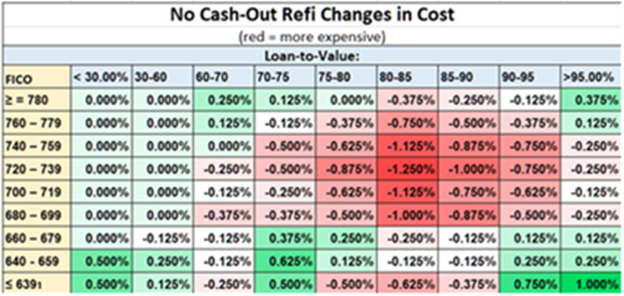

So where is the noise coming from? When compared to LLPAs currently in place, the new adjustments are slightly higher for borrowers with higher credit scores, and slightly lower for those with lower scores.

LLPA Fee Changes By Credit Score

As we can see from the figures above, the change in LLPAs from previous fees are indeed going up for some higher credit borrowers, especially for those with LTVs in the 80 – 95 range.

However, we do not recommend skipping your credit card payments just yet. Low credit borrowers will still have larger (more expensive) pricing adjustments – but the gap between high and low credit borrowers will be smaller in some instances.

The Federal Housing Finance Agency released a statement on Tuesday to clear up the confusion, asserting “Higher-credit-score borrowers are not being charged more so that lower-credit-score borrowers can pay less. The updated fees, as was true of the prior fees, generally increase as credit scores decrease for any given level of down payment.”

The agency even went so far as to include an individual contact, so if you have any questions or just want to tell him he’s doing a great job, reach out to Adam at Adam.Russell@FHFA.gov.

The Rocket Pro TPO roadshow rolled on this week with leaders visiting partners in San Diego, the New York area, Minneapolis and San Francisco.

Check out Divisional Vice President Mercel Salamey and President’s Club Account Executive Keri Stichler with our friends from Heritage Mortgage Banking Co. and Heartland Mortgage Corporation!

- National Association Of REALTORS' Stance On New LLPAs

- Low-Income Homebuyers Are Less Likely To Migrate From Cities

- FHFA House Price Index Up 0.5% In Feb.

- Residential Sales March 2023

- Real Gross Domestic Product Comes In At 1.1% Annual Rate

Coming Soon! May’s IGNITE Live!

Join Fawaz LIVE on Monday May 8 at 2:00 p.m. ET for the latest from Rocket Pro TPO.

Josh Wescott’s 22-second solve was 13 seconds faster than the next best time, earning him top spot in last week’s puzzle. Shoutout to all six who completed the puzzle in less than a minute!

This week’s puzzle gets 3 Rockets out of 5. Click here to solve!