Rocket Fuel Newsletter – 03/25/2024

As of this writing, Congress has received but not yet voted on a $1.2T spending bill ahead of the March 23 deadline. It is expected to pass, and if it does, we all would get a much-deserved break from shutdown talks ... but only until the fall.

In this edition: the impact of last year’s HUD decision, a unique IPO and part 3 of our look into the FOMC.

Fuel Up! 🚀

Borrowers Save $600 Million With Annual Mortgage Insurance Premium Cut

One year ago, the U.S. Department of Housing and Urban Development (HUD) implemented a 35% cut in the price of the annual mortgage insurance premium (MIP) paid by borrowers with FHA-insured mortgages. Over this period, the premium reduction has enabled almost 700,000 borrowers to save $876 annually, resulting in a collective savings of $600 million in a single year!

In the words of Federal Housing Commissioner Julia Gordon, “At a time when homebuying has become more expensive and feels out of reach for many, the MIP cut puts money back into the pockets of American homebuyers and helps more well-qualified borrowers achieve the benefits of homeownership.”

Existing-Home Sales Up in February

National Association of REALTORS (NAR) data showed existing-home sales experienced an upswing in February, increasing by 9.5% and reaching a seasonally adjusted annual rate of 4.38 million units. While sales saw a 3.3% decrease compared to the previous year, the increase last month marks the most significant monthly surge since February 2023.

Reddit Goes Public

Breaking ground as the first major social media company to go public since Snapchat in 2017, Reddit has made its long-awaited IPO entrance – with a twist. Reddit has announced its intention to reserve shares for top users to purchase, determined by their “karma” – a metric indicating user engagement and reputation on the platform.

“RDDT” opened at $47 and peaked at $57.80 early Thursday afternoon, marking an impressive 70% surge from its initial offering price of $34. Shares peaked at a market cap of approximately $10.9 billion.

Hey Fawaz! 👋 Do you have any information about rate cuts!?

Welcome to the final installment of our deep dive into the Federal Open Market Committee (FOMC)!

Unsurprisingly, the FOMC voted unanimously to leave rates unchanged in their March 19 meeting; this was the fifth decision in a row to keep the federal funds rate target between 5.25% and 5.5%.

In the committee’s statement, they said that “inflation has eased over the past year but remains elevated,” pointing to the higher-than-desired inflation readings from last week.

Since yesterday’s outcome was so widely expected, there was not much turbulence following the announcement or Chairman Jerome Powell’s press conference, though markets did close at record highs.

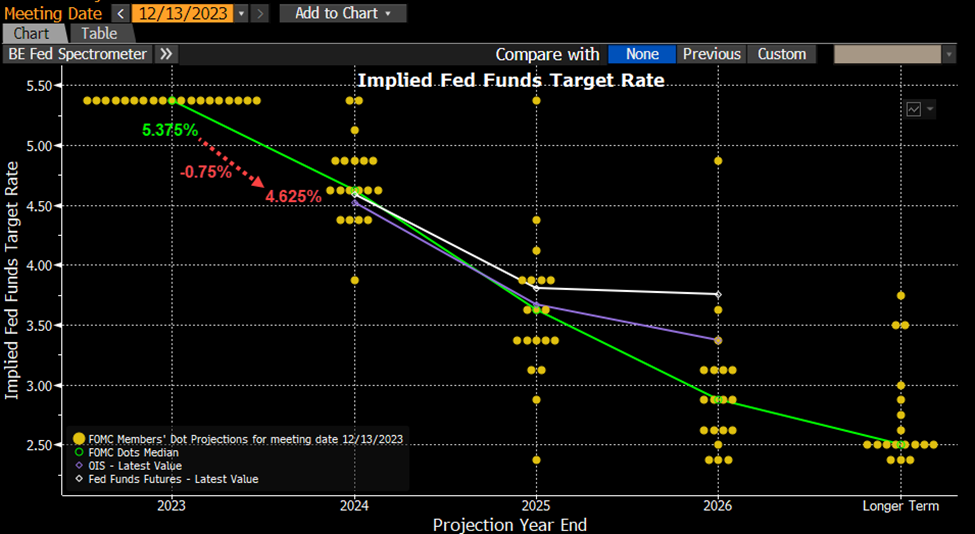

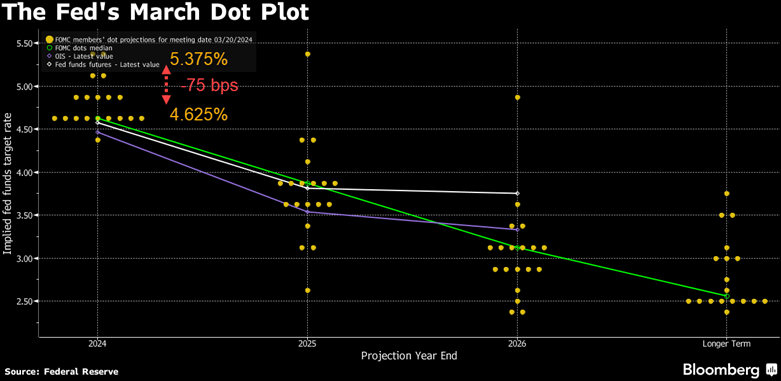

More important from yesterday was the quarterly “Dot Plot” update – a chart that shows where each FOMC member thinks interest rates will be by the end of this year as well as several years in the future. It’s by no means an official projection, but rather a temperature check of each FOMC member’s feelings toward cuts and hikes, and how often the federal funds rate should be adjusted.

December 2023 FOMC Dot Plot

March 2024 FOMC Dot Plot

The two dot plots did not change much for 2024, except in there being more of a consensus on 4.625% as the projected year-end federal funds target rate. The projections for 2025 and 2026 also ticked up slightly from December to March.

The other point of emphasis in 2024’s updated projections is understanding where we are now versus where the Fed expects us to be. The FOMC’s implied 2024 rate of 4.625% is 0.75% below our current rate of 5.375%, which means the committee still expects to cut rates multiple times between now and 2025.

Jerome Powell spoke to this expectation in his post-meeting press conference, though he reiterated the need of the committee to see more convincing evidence that inflation is truly headed toward their stated goal of 2% before they begin cutting rates.

The FOMC meets next to discuss the future of the federal funds rate on April 30 – be sure to reference parts 1 and 2 of this series in the lead-up to their next rates decision on May 1!

- Read The Full Text Of The $1.2T Spending Bill

- Watch Jerome Powell’s Post-FOMC Meeting Press Conference

- Home Builder Confidence Rises

- Existing Home Sales Jump In February

Mike C (44 seconds) and Andy C (52 seconds) were the only two to finish last week’s challenging puzzle in less than a minute; congrats to all solvers who attempted and solved it!

This week’s puzzle gets 2 Rockets out of 5.