Rocket Fuel Newsletter – 03/18/2024

Ever wonder what it takes to open your own brokerage in today’s mortgage industry? Listen to how Blake Bianchi of Future Mortgage did it in the latest episode of Build-A-Broker™: The Journey, sponsored by Rocket Pro℠ TPO, and be sure to catch more stories like Blake’s on the second and fourth Wednesdays of each month!

Listen here!

Fuel Up! 🚀

First-Time Home Buyer Credit

The Biden administration has created a plan to help first-time home buyers (FTHB) overcome today’s home affordability issues. The “mortgage relief credit” provides a $5,000 tax credit per year for the first 2 years of owning a home. This discount is akin to reducing the interest rate on a median-priced home by 1.5% for 2 years.

As first-time home buyers made up 39% of the home buying market in 2023, the highest amount in the past decade, this is a huge opportunity for the newest generation of homeowners.

Read more about the credit in the March 2024 Mortgage Monitor.

Declining Internal Migration Within The United States

The U.S. has historically had high internal migration, and that willingness to move has contributed to the reputation of having a dynamic national economy. However, it appears that citizens have become less responsive to internal migration than in decades past, even when home prices increase in their area.

Read more in this article from the National Bureau of Economic Research.

Selection Sunday = Bracketology Monday

It's that time again! March Madness is officially set to begin later this week – will you defy the 1-in-9.2 quintillion odds and post the first-ever perfect bracket?

Not a sports fan? No worries, there are brackets for everything!

Check out this Disney Vs. Pixar movie bracket!

Hey Fawaz! 👋 Talk to me about jumbo!

Ray Edwards, Edwards Financial Services LLC

Tell us about the beginning of your career. What got you started?

When I got off active duty with the U.S. Army in 1976, I went to work for a local savings and loan association. Our branch customers were asking for home loans but our loan department wasn’t giving very good service so I asked my boss if I could do their loans. He agreed and that was the beginning of a nearly 50-year career in the mortgage business.

What’s your favorite thing about being in this industry?

The satisfaction I get with assisting someone with such an important and often life-changing purchase is very rewarding, and I have learned so much from the people I have helped.

They have lived all over the world, held every imaginable career, and had fascinating stories to tell. There have been too many times to count when someone I am helping has something in common with another borrower or could use advice from one of my past borrowers and every time they appreciate being remembered and getting connected. That satisfaction never gets old.

What is something you are incredibly proud of within your business?

Repeat business is something I feel honored to receive. I have done many loans for the families and friends of past borrowers and knowing that they trust me and remember me is truly satisfying.

Letting people know that their story matters to us and that we value them not just as customers but as people gives us a sense of purpose and at the end of the day allows us to look in the mirror and truthfully tell ourselves that we did something good today.

What are you most excited about for the future?

I’m excited about what the future holds for our business and how the next generation of leadership is adapting to the changes that are coming. We have to encourage innovation and efficiencies in marketing and origination while remembering the basics of what makes a quality loan for our wholesale lenders.

Those of us in my generation need to mentor the next generation of the mortgage industry or we will find ourselves becoming irrelevant and legislated out of business. Giving back to our industry and helping guide the next generation is rewarding and keeps me young!

Why Rocket Pro TPO?

Rocket Pro TPO was the unanimous choice of our origination and processing staff and the first lender we signed up with [when we recently reorganized our business]. It also was the easiest to re-sign with. Having a lending partner who truly values our business and treats us more like a friend than just a business contact fits with our company ethos.

Rocket Pro TPO has invested into our company success by inviting us to the All Access event, connecting us with their partners in other states when we needed a contact, and has supported our activities with NAMB and our state’s professional organization. I couldn’t think of a better partner than Rocket!

Last week, we kicked off our three-part series on the federal funds rate with a deep dive into what it is and its role in the economy. This week, we explore what the Federal Open Market Committee is and what it looks at to set rates.

What is the committee, and how did it come to be?

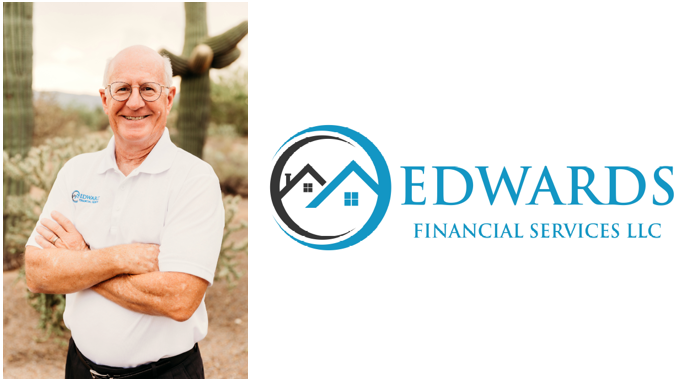

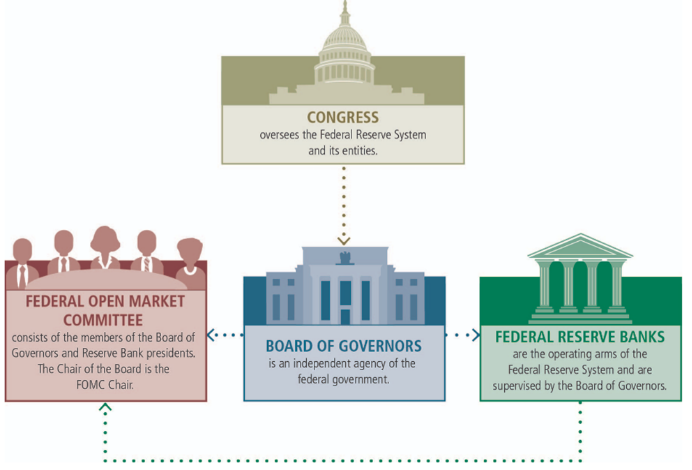

After a series of bank runs in the early 1900s, the Federal Reserve was created in 1913 to address the panic. Congress created a decentralized system of twelve separate districts to operate independently of each other to better supervise the banking system.

The downside of the independently operated districts was a lack of accountability and action. Without any clear leadership, decisions were hard to come by. From this concern, the Federal Open Market Committee (FOMC) was created between 1933-1935 and was put in charge of setting monetary policy.

The FOMC is made up of members from the Board of Governors and Federal Reserve Bank presidents. The FOMC Chair is nominated by the president; Jerome Powell currently holds that position and has since 2018.

At the eight meetings per year, the committee discusses economic and financial conditions to determine the appropriate monetary policy. The Fed has a dual mandate: stable prices and maximum employment. The committee constantly pores over economic data, and at these meetings, they discuss the current state of the economy and how they can best serve their dual mandate.

How does the committee assess the health of the economy?

Some of the key reports that the FOMC uses to gauge the economy are:

- Gross Domestic Product (GDP): A measure of the final goods and services produced in the United States. This is the most popular indicator of the nation’s overall economic health.

- Unemployment Rate: The number of unemployed as a percentage of the labor force.

- Consumer Price Index (CPI): The average change over time in prices paid by urban consumers for a market basket of consumer goods and services. It is one of the reports used to measure inflation.

- Personal Consumption Expenditures (PCE): The preferred measure of inflation for the Fed. It is a measure of the prices that people living in the U.S. pay for goods and services. It captures inflation or deflation across a broad range of consumer expenses and reflects changes in consumer behavior.

- New Residential Construction (Housing Starts): The number of new housing units started by home builders.

- Consumer Confidence: Reflection of business conditions and likely economic development for the months ahead. Tracks consumer attitudes, buying intentions, vacation plans and expectations for inflation, stock prices and interest rates.

- Fed Biege Book: A summary of economic conditions in each of the 12 Federal Reserve districts. It provides information on current economic trends and challenges faced by businesses in various sectors, helping the FOMC gauge regional differences and broader economic conditions.

What does the committee control?

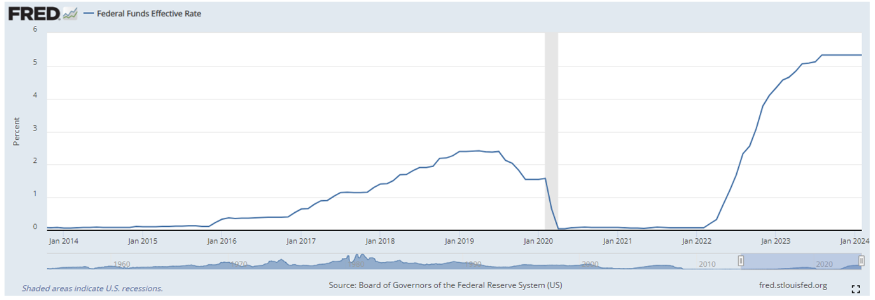

The biggest lever that the FOMC can pull is adjusting the federal funds rate, which is something they have relied heavily on over the past few years to rein in inflation. As inflation started to rise throughout 2021 and into 2022, it brought into focus the dual mandate of the Fed, specifically stable prices.

To counteract the rising prices, the FOMC swiftly raised interest rates to try and moderate the economy.

This has helped lead us to where we are now, which is a waiting period.

Progress is being made toward returning to stable prices with an overall target inflation rate of 2%, but the FOMC has stated they want to see further indications from the aforementioned data points that prices will remain stable before lowering the federal funds rate. The next meeting for the committee is March 20; afterward, the final installment of our three-part series will recap the decisions made by the committee at that meeting. Stay tuned!

- Consumer Price Index Summary – February 2024

- HUD Launches Website to Combat Source Of Income Discrimination For Families Using Housing Vouchers

- HUD Awards $2.75 Million To Train And Equip Skilled Housing Counseling Professionals

- The Federal Reserve’s Beige Book – February 2024

- Bitcoin Halving: When Will It Happen And What Does It Mean For The Price?

Blink and you might miss Michael Bazavilvazo solving a puzzle – he finished last week’s puzzle in just 13 seconds! Congrats to the other 7 who finished in under a minute, as well as all 300+ solvers we had last week!

This week’s puzzle gets 4 Rockets out of 5.