Rocket Fuel Newsletter – 03/11/2024

According to Merriam-Webster, English speakers are now allowed to end a sentence with a preposition. Will they tackle the Oxford comma controversy next?

In this edition: the latest from Jerome Powell, part one of a three-part series on the Fed’s federal fund rates, and Rocket ProSM TPO’s first All Access of 2024!

Fuel Up! 🚀

Big Week For Jerome Powell

Jerome Powell testified before Congress last week – among the topics covered were interest rates and a regulation called Basel III.

Powell was less hawkish than many expected and calmed worries that folks like former Treasury Secretary Larry Summers stoked about the Fed potentially raising rates again this year. Meanwhile, Basel III, an international regulatory framework for banks that has been keeping capital requirements managers up at night for some time, could be changed before it goes into effect in 2025.

Watch his entire testimony here!

Government Shutdown (Temporarily) Averted (Again)

In what is becoming the longest, most dangerous game of “kick the can” in recent history, the House once again passed a bipartisan set of stopgap bills aimed at avoiding a partial government shutdown on March 8. Several departments, including Agriculture, Commerce, Interior, Justice and Transportation, will be funded through September, while other departments like Defense and State now face a March 22 deadline for further funding.

Should We Be Surprised?

In his latest attempt at humor, Elon Musk offered to drop his lawsuit against OpenAI if they change their name to ClosedAI. Just a reminder that we’re all still waiting on the fight between Musk and Mark Zuckerberg.

Danny Talia, Simpler Home Loans

Tell us about the beginning of your career. What got you started?

I was working at one of the big banks as a personal banker in the early 2000s and started doing mortgage refinances as rates were coming down at that time. [From there,] I was immediately attracted to helping clients with their mortgage needs.

Tell us about some of the biggest lessons you’ve learned in your tenure.

Have clear and concise core values that you strongly believe in and use that as a lens when making any business decision. That includes the way we help clients and support Loan Officers.

We were blessed and fortunate to make Rocket’s Top 100 Mortgage Brokers in 2023 and we want to be in the Top 50 this year. I think we can do that by growing the team with professionals that believe in the same core values.

What is one thing you wish you knew when you got started?

[It] took me a couple of cycles to get this, but understanding the ups and downs that the bond market can create and to ensure you are able to pivot for sustainability.

What is one thing you want to learn this year?

[I’ve] been trying to read up on venture capitalist funding, [and] would love to get connected with people in that industry.

How would you describe your brand?

I feel that our brand is all about transparency. That is transparency for the Loan Officer and the Client. Unfortunately, that is lacking quite a bit in our industry.

Why Rocket Pro TPO?

[Rocket Pro TPO has] been there for us since Day 1. Since the first call I had with our AE, Alanna, she believed in us. She put us in touch with our amazing DVP, Scott Fishman, who held bi-weekly meetings with us to discuss our progress. They did that for us for 60+ days before we even got our first license officially approved to be able to even take an application. We will never forget that and appreciate it more than we can explain.

So much fuss is made over the Federal Reserve and their federal funds rate, but many do not truly know what it does or how its impact is felt across the economy.

This week, we’ll answer the basic questions of “what is the federal funds rate, what does it impact and what does it mean for mortgages?” Next week, we’ll delve deeper into the key metrics that the Fed uses to set rates. All of this background will lead into an analysis of the March FOMC meeting, where Jerome Powell and the Fed will make their next decision on the federal funds rate.

Read part one of our three-part series!

Nearly 500 partners and real estate agents from across the country joined us in Detroit for our first All Access event of 2024. Attendees saw firsthand the depth of Rocket’s culture and mission, and were also treated to a fireside chat between Fawaz and Rocket Mortgage General Manager Alpa Lally.

Thank you to all who joined us and brought the energy to both days!

- Jerome Powell Gives Additional Clarity On Inflation And Rate Cuts

- HUD Makes $10 Million Available To Support New Homebuyers And Bridge Wealth Gap

- Suburban Home Values Up 5.6% Last Year

- Fannie Mae Enhances The Streamline Mortgage Origination Process

- One Year After The Collapse Of Silicon Valley Bank

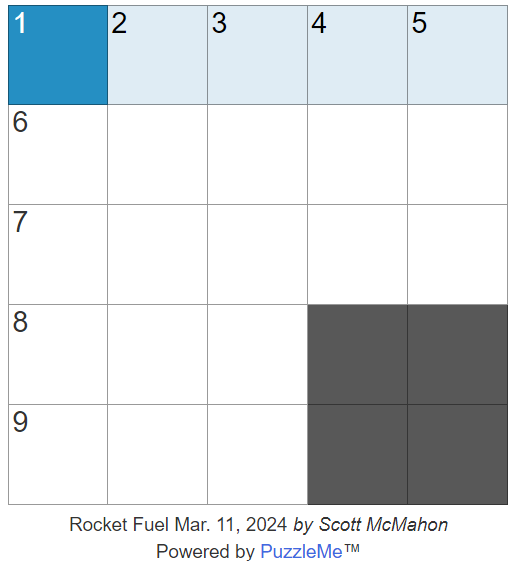

Kudos to all solvers who took on last week’s tough puzzle; just 5 players finished in less than 2 minutes! Somehow, Ali W. managed a time of just 38 seconds to lead all solvers.

This week’s puzzle gets 2 Rockets out of 5.