Rocket Fuel Newsletter – 09/10/22

The NFL season is upon us! Sorry, Cowboys fans, but some pundits are calling our Detroit Lions “America’s team” after the most recent season of Hard Knocks.

This week’s edition includes changes within the United Kingdom and a look at consumer credit.

Fuel Up! 🚀

Biz Buzz

All Eyes On The United Kingdom

Liz Truss took over as Prime Minister of the United Kingdom on Tuesday and has already revealed plans to cut taxes amid rising inflation and a major energy crisis in the country. As Russia has cut off the UK’s gas supply during the war with Ukraine, British politicians have looked into the practice of fracking for natural gas and freezing energy prices for consumers.

On the heels of Truss’ assumption of power, Queen Elizabeth II passed away on Thursday. The longest reigning monarch in British history held the throne for 70 years and oversaw the decolonization and modernization of the British economy following World War II.

Changes in legislative power are volatile enough; add in the first monarch change in 70 years and all eyes will inevitably focus on the United Kingdom and how they adjust to two new leaders.

Powell Speaks At Cato Institute

FOMC Chairman Jerome Powell took part in a Q&A session at the Cato Institute on Thursday, during which he addressed the direction of the Fed with regard to more rate hikes or policy loosening.

Spoiler alert: Rate Hikes Ahead

Caffeinated Trends

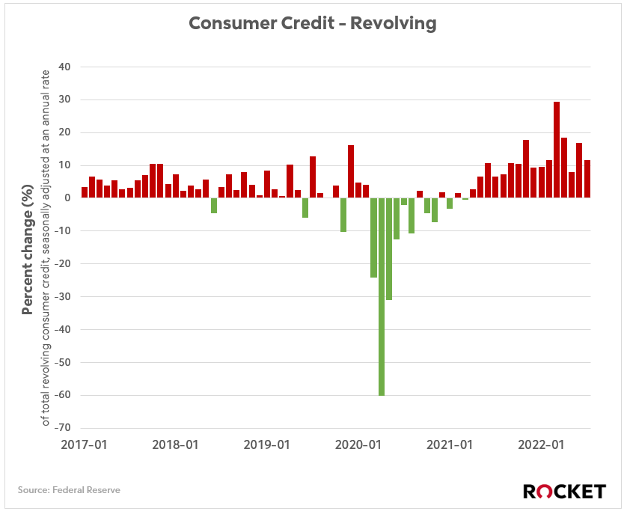

Yesterday’s consumer credit from the federal reserve showed an unexpected drop in credit growth last month.

At the beginning of the pandemic, credit card balances diminished greatly and personal budgets looked better than ever.

This year, we made up for that time below average with some additional growth as inflation forced folks to pony up and pay a little more.

This cycle, folks have a lot more equity in their homes to tap to keep credit card balances in check, and with recent reports showing inflation to finally be transitory, interest rates won’t stay high forever.

In The Weeds Reads

Pro Puzzles

Nine seconds! The time it will take you to read this sentence was how fast Will finished the puzzle last week. Great work to Will and to the other 14 who solved last week’s puzzle in less than a minute.

This week’s puzzle has some bite to it. We give it 4 out of 5 Rockets.