Rocket Fuel Newsletter – 07/09/22

This week’s edition includes a look into investment properties, the July Jobs report and how “Elf” helps one partner reach their audience.

Fuel Up! 🚀

Biz Buzz

THE jobs report (non-farm payrolls) came in strong Friday with the unemployment rate remaining at 3.6% as the economy added 320k jobs last month.

Many in the media are commenting that “this doesn’t look like a recession,” but since the Fed has the dual mandate of balancing inflation and the strength of the labor market, they continue to hike interest rates.

Caffeinated Trends

Anyone who traveled over the Fourth of July long weekend can attest to the fact that travel is back. This Travel Pulse article concludes that longer international and domestic stays, pet-friendly spots for your barky friend Buddy, and immersing yourself in wellness and outdoor activities are among the emerging post-pandemic travel trends this year.

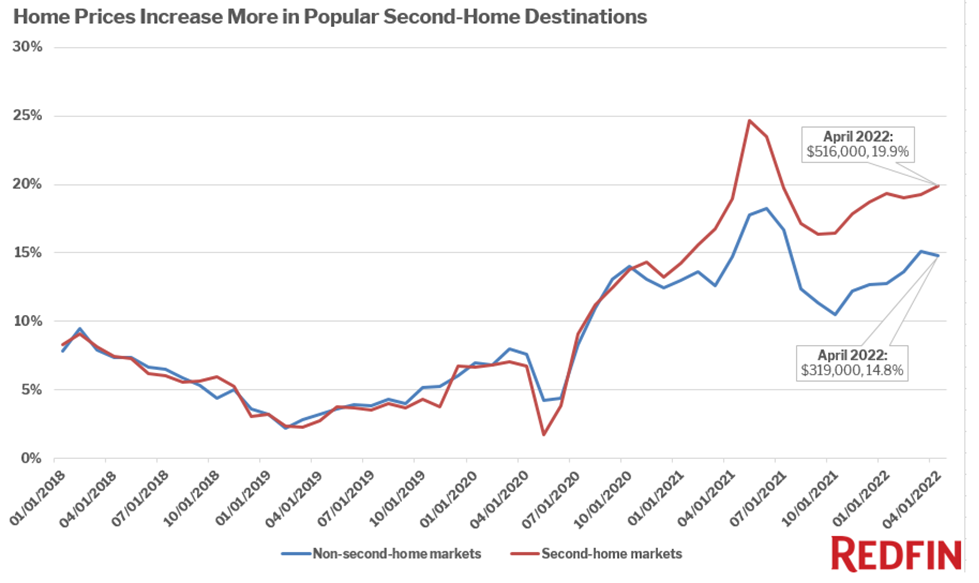

Those lucky ducks who traveled to their vacation homes in Phoenix, Cape Coral, Naples, Myrtle Beach, or Las Vegas likely saw large equity gains since last Independence Day.

Similar to the overall housing market, the second-home market has cooled this summer relative to 2020 and 2021. However, demand is still relatively strong, especially as employers continue to offer remote work options, and inventory is beginning to creep up from historical lows.

For clients who are looking to purchase a home away from home (see if their dream getaway property is located in Pacaso’s top 50 second-home markets here), here’s some useful facts to know:

- Second-home loans usually have a lower interest rate than investment-property loans and only slightly higher interest rates than first-home mortgages, but

- To qualify for a second home, some lenders dictate that the property be located in a resort or vacation area or must be a certain distance from your primary residence

- Although rental income cannot be used to qualify for a second home mortgage, you can still rent out your second home as long as you meet occupancy requirements

- Contrary to popular belief, the minimum down payment requirement is 10%

Partner Spotlight

VIP Mortgage Group, Orlando, FL

Christian Plocica – COO

Favorite vacation spot: “I’ve been on about 4-5 cruises in the past 10 years to the Bahamas and the Caribbean.”

First job: “Delivery boy for Mike’s Pizzeria in Brooklyn, NY – fuhgeddaboudit.”

Coffee preference: “Neither – Cherry Coke Zero”

First concert: “KC & JoJo back in 1999”

Does pineapple belong on a pizza: “Absolutely not. That’s the cardinal sin.”

Favorite things about Rocket:

- Pathfinder: “It can make or break a deal … if you feel like something is off or has a little hair on it, just go to Pathfinder.”

- Team Members:

- “In conjunction with Pathfinder is SOS. I typically call them and ask if I’m correct in my interpretation of Pathfinder.”

- “From the AEs to the Crew members, I just love how … they’re always wanting to get better and improve things.”

- Breadth of resources: “No matter how much experience you have or how much you think you know, the resources are only going to make you better.”

How does dressing up like Buddy the Elf drive mortgage business? It’s no joke – Christian Plocica, COO of Orlando, Florida’s VIP Mortgage Group, reenacted several iconic scenes from the movie “Elf” around the Orlando area for the sole purpose of increasing engagement on his company’s social media outlets.

“We just want to be a little different with the video content – not just the plain social tiles. We feel that’s what people want to see rather than reading mortgage terminology.”

After opening their doors in December 2020, Christian and his team quickly realized how valuable social media marketing could be. With how engrained social media has become in today’s society, dominating the algorithms with fresh, engaging content allows people and companies alike to not only create a sphere of influence, but to stay top of mind within that sphere.

VIP Mortgage Group’s social media personnel includes Christian, his internal team, as well as a third-party vendor that provides analytics and suggestions for improving the company’s reach. The team holds regular media days, during which the entire staff helps brainstorm ideas for future content, and Loan Officers often get to put themselves in front of the camera.

They do plenty of mortgage-specific content, like clear to close celebrations, meet the team videos, and client testimonials, but they also make it a point to feature content that has nothing to do with the mortgage industry.

“We try to do events and then spotlight those events and the good things we’re doing around the community. It’s not just ‘What’s PMI?’ or “Did you know you don’t need to put down 20%?’. We’re human, we’re in your backyard, and we’re pretty good at what we do.”

Alongside their mortgage content, VIP Mortgage Group’s Facebook page and Instagram page are filled with bite-sized holiday-related posts, inspirational quotes and Loan Officer interviews. And speaking of bite-sized, following an impromptu pizza review in Detroit this spring at Rocket ProSM TPO’s first All Access event, Brooklyn-raised Christian began sampling pizza from around the Orlando area with local REALTORS® to grow relationships and feature local businesses.

It may seem like a lot of time trying pizza and finding the perfect Buddy the Elf costume, but Christian’s goal is to make his team relatable and credible when it comes time for clients to decide on a mortgage broker. He argues that in today’s world, especially among a key demographic, a potential client will have a greater level of trust in a company that effectively uses social media versus one with no online presence.

“[Social media] legitimizes us in a big way, especially with the younger crowds who are searching places right away and doing their due diligence to get more information.”

For anyone looking to expand their social media presence, Christian offers two pieces of advice:

- Understand your “why”: “You don’t just want to post to post. Try to have a plan and understand what you want out of it. Do you want laughs? Likes? How is this going to be different from any other marketing?”

- Learn how to be comfortable being uncomfortable: “If you want to be really good with social media, you have to learn how to be in front of the camera. … I promise you every time I still go in front of the camera, I’m nervous. But have fun with it and just do it.”

Learn to overcome credit objections at this month’s Sales Training!

In this competitive market, pulling a client’s credit can occasionally cause difficulties. Some partners are met with client resistance and are hearing: “I don’t want you to pull my credit” or “I do not provide that information over the phone.” We have some great solves. If you’re looking for some time-tested strategies to consistently guide your clients past credit-based concerns, this Sales Training class is for you! Join us and get the skills to make the credit pull experience more comfortable for your clients. Learn how to:

- Solve a problem with simple tactics. Simplicity is genius.

- Address underlying concerns: Learn what drives credit objections.

- Respond to credit objections in a positive way.

- Pivot to a tactful second and third credit request.

- Increase lead to credit and credit report viewing opportunities.

Partner with us and learn to overcome credit objections at this month’s Sales Training!

In this competitive market, pulling a client’s credit can occasionally have difficulties. Some partners are met with client resistance and are hearing: “I don’t want you to pull my credit” or “I do not provide that information over the phone.” We have some great solves. Partner with us and get time-tested strategies to consistently guide your clients past credit-based concerns and make the credit pull experience more comfortable. Learn how to:

- Solve a problem with simple tactics. Simplicity is genius.

- Address underlying concerns: Learn what drives credit objections.

- Respond to credit objections in a positive way.

- Pivot to a tactful second and third credit request.

- Increase lead to credit and credit report viewing opportunities.

If you partner with us, you’ll be able to attend this month’s Sales Training – part of our complete Pro Performance training program. Contact your Partner Development Manager to sign up today and begin the fast onboarding process.

In The Weeds Reads

Pro Puzzles

Only two solvers finished last week’s puzzle in under two minutes, and somehow Bryan was able to finish in just 25 seconds! Shoutout to Zach A at 1:42 for another stellar performance.

This week’s puzzle is slightly shorter and easier. We give it 2 Rockets out of 5.