Rocket Fuel Newsletter – 06/04/22

With Summer underway and the NBA and NHL seasons winding down, let's not let Memorial Day pass too quickly across our busy schedules.

This week’s edition highlights 10 key benefits for veteran homebuyers and how to market them!

Fuel Up! 🚀

Bizz Buzz

The Good: The Light At Ahe End Of The Tunnel

Randy Brown, broker and owner of Traverse City’s Versatile Mortgage, LLC, predicts relief is coming on the mortgage rate front, likely in 4Q- 2022.

A respite from climbing rates would give struggling buyers their purchasing power back, but still chill the market long enough to replenish housing inventory, temper appreciation rates, and slow investment activity.

The Bad: Slow And Slower

As inflation remains elevated, costs of goods and services continue to eat up larger portions of consumers’ disposable personal income (DPI). The personal saving rate declined to the lowest point since September 2008, just 4.4% of DPI.

Lower savings is another barrier to first-time homebuyers, especially if they are looking to come up with a 20% down payment on their home purchase.

Meanwhile, consumer confidence decreased in May and purchasing intentions of big-ticket items like homes cooled, according to the Conference Board.

The initial employment report by ADP also suggested hiring slowed in May amid fears of a broader economic slowdown.

Caffeinated Trends

Just because Memorial Day has passed and you're allowed to wear your white pants now, doesn't mean you should stop thinking about those who've sacrificed to secure the future of America.

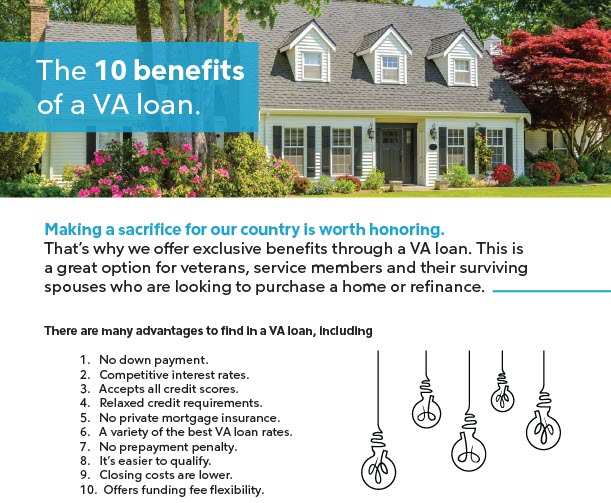

Last week we broke down some misconceptions surrounding the VA mortgage product. It's important our Veterans have clear and transparent access to their benefits. When it comes to marketing, busting myths is a great way to get people's attention. Once you've got their attention, bring them home with the value and the benefits.

Here are 10 benefits of a VA loan you can share with potential purchase borrowers on social media:

Next steps:

Real estate agents should partner up with mortgage brokers and do co-branded marketing to build trust and strong relationships with clients.

Teamwork makes the dream work with Pathfinder enabling succinct answers to nuanced guideline questions and empowering expert brokers to bust myths on the spot.

Check out the TPO Marketing Hub to gain access to the flyer above and other social marketing content.

Bonus:

Most of the veterans in America live in California, but only 10% of the purchase loans in California are VA.

If you're looking to expand licensing to a new state and being hyper-focused on serving our veterans, consider some of these other states with a higher proportion of Veterans living there.

In Alaska, its 35-40% Veteran borrowers when it comes to purchase mortgage business.

Fast 15 Guarantee: Extended Through June 2022!

Due to incredible results and great feedback from our partners, we’re extending our powerful Fast 15 Guarantee through June 2022. We promise all eligible purchase loans will be clear to close in 15 business days, or we’ll give your clients $2,500!1 Our Fast 15 Guarantee also covers correspondent partners! We guarantee that eligible loans will be clear to close in 15 business days, or we’ll waive the $999 acquisition fee.2 Use the Fast 15 to make offers stand out and convert preapprovals at a faster rate!

In The Weeds Reads

- US S&P CoreLogic Case-Shiller Index Acceleration Peaks Prior To Mortgage Rate Surge, Up 20.6% Annually

- Majority Of Aging Adults Likely To Age In Place

- Metro Area Housing Wealth Gains

- Vacant Zombie Properties Rising In Q2 Amid Jump In Foreclosure Activity

- U.S. House Prices Rise 18.7% Over The Last Year; Up 4.6% From Q4

Pro Puzzles

John F had the fastest solve time last week; his time of 33 seconds beat out Thomas by just 1 second. Our average solve time was 3:09.

This week’s puzzle includes a bit of a meta theme to up the difficulty a bit. We give it 4 Rockets out of 5 – that's no lie!

DISCLAIMERS:

1Client will receive a lender credit of $2,500 if client’s loan is not cleared to close within 15 business days of a new wholesale purchase loan application submission through a Rocket TPO broker. Offer excludes VA, FHA, and any loan utilizing down payment assistance programs. Offer not available in Alaska, Hawaii, Idaho, Iowa, Maine, Massachusetts, Montana, Nebraska, New Hampshire, New Mexico, New York, North Dakota, Oklahoma, Rhode Island, South Dakota, and Vermont. Offer not available on multi-unit houses, condominiums, co-ops, new construction loans, or properties valued at over $2,000,000, and any properties that require two appraisals. Broker must submit all required documentation for final review by the 13th day of the offer period for loan to qualify for the offer. Appraisal must be ordered within 24 hours of the loan being submitted to underwriting. Partner must have title fully cleared by the final day of the offer period. Client is only eligible for the $2,500 lender credit if Rocket Mortgage is solely responsible for failing to clear the loan to close by the offer period. If the loan fails to close outside of Rocket Mortgage’s control for any reason, including, but not limited to, new information that changes the underwriting approval decision to a denial of credit request, lack of satisfactory insurance or appraisal, title issues, or client disengagement or refusal to respond, then the client is not eligible for the $2,500 lender credit. Rocket Mortgage reserves the right to cancel/modify this offer at any time. Offer is nontransferable. This is not a commitment to lend. Additional restrictions/conditions may apply.

2The acquisition fee of $999 is waived for a Correspondent Lender if, their client's loan is not cleared to close within 15 business days of Rocket Mortgage receipt of all necessary documents to underwrite the loan. Offer excludes VA, FHA, and any loan utilizing down payment assistance programs. Offer not available in Vermont, South Dakota, North Dakota, Alaska, Maine, New Hampshire, Hawaii, New Mexico, Oklahoma, Nebraska, Montana, Massachusetts, Iowa, New York, Rhode Island, and Idaho. Offer not available on multi-unit houses, condominiums, co-ops, new construction loans, properties valued at over $2,000,000, and any properties that require two appraisals. Correspondent Lender must submit all required client and third-party documentation, including but not limited to title commitment and appraisal, for final review by 3 pm property time on the 13th day of the offer period to qualify. The Correspondent Lender is only eligible for the waived acquisition fee if Rocket Mortgage is solely responsible for failing to clear the loan to close by the offer period. If the loan fails to close outside of Rocket Mortgage’s control for any reason, including, but not limited to, new information that changes the underwriting approval decision to a denial of credit request, lack of satisfactory insurance, appraisal, title issues, or client disengagement or refusal to respond, then the $999 fee will not be waived. Rocket Mortgage reserves the right to cancel/modify this offer at any time. Offer is nontransferable. This is not a commitment to lend. Additional restrictions/conditions may apply.