Rocket Fuel Newsletter – 05/14/22

This week’s edition looks at the correlation between home inventory and housing prices, key economic indicators, and a Rocket ProSM TPO partner dominating social media.

Fuel Up! 🚀

Biz Buzz

Consumer Price Index (CPI) Increased More Than Expected In April

Inflation rose 8.3% in April compared to the same month last year, which was more than anticipated. Even core inflation, which excludes volatile food and energy prices, exceeded expectations, increasing 6.2%.

As inflation of consumer goods persistently outpaced wage growth, U.S. consumer debt skyrocketed 14% annually in March. Paying back debt will get even more expensive as interest rates rise with the Fed’s efforts to combat inflation.

MBA Purchase Mortgage Applications Grow 5% Week Over Week

Even after adjusting for seasonality, purchase mortgage applications ended the first week of May with 5% growth, offsetting a 2% decline in refinance applications.

What’s Going On With Crypto?

A dip in TerraUSD, an algorithmic stablecoin that should keep a 1:1 ratio to the dollar, was trading around $0.80 this week. Cryptocurrencies typically move in the same direction as stocks.

While securing a mortgage with crypto is not currently a widespread practice, it is not unheard of for crypto assets to be involved in real estate transactions, especially in Miami. If volatility continues in the stablecoin market, crypto will face even larger headwinds in becoming an accepted form of payment.

Caffeinated Trends

In the span of 15 months since bottoming out around 2.65% during the first week of January 2021, 30-year mortgage rates have risen to 5.30% (Freddie Mac rate survey). This 2.65% increase in rate equates to roughly a 26.5% decrease in purchasing power for prospective home buyers.

This downward pressure on purchasing power leads us to the next question: When will home prices follow, if they do at all? While no one knows for certain, we do know which metrics to follow.

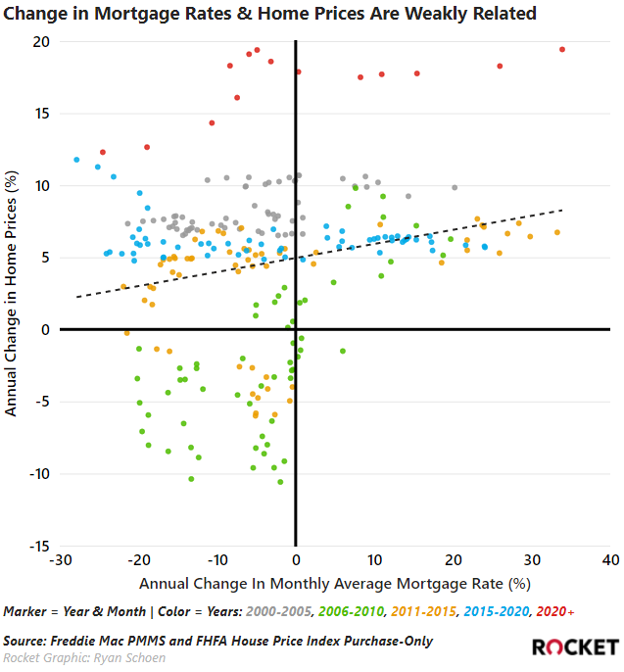

Home price movement is downside-sticky which means that prices tend to move up easily but don’t move down easily. They also tend to be a lagging indicator, so movement in mortgage rates are weakly correlated to home prices.

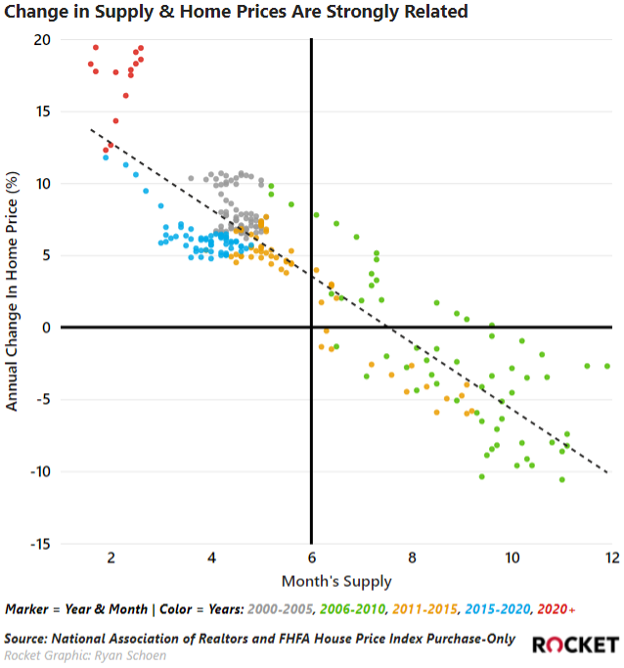

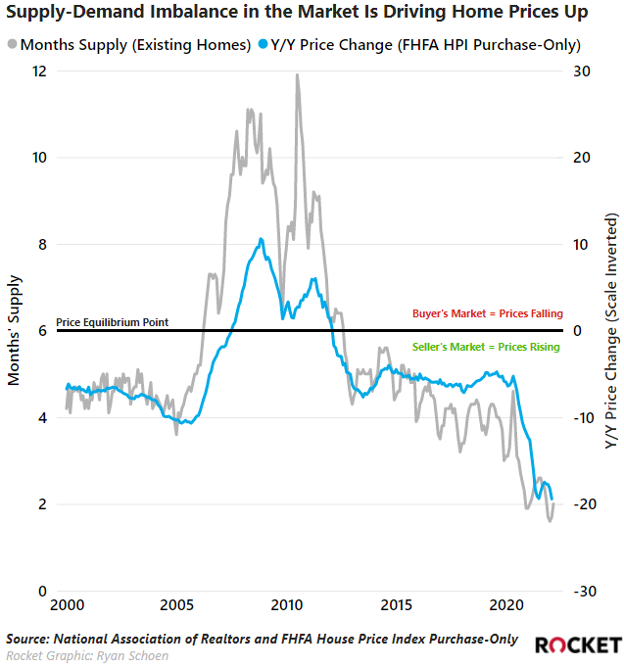

Instead, all eyes move on from rising mortgage rates to what it may impact, which is housing supply. The level of housing supply has a strong inverse relationship to price movements historically and is the key to when we will start to see rising home prices abate.

In March, the National Association of REALTORS reported that the existing home market (~90% of home sales) is operating with just 2 months’ supply – a far cry from the 6 months’ supply needed for price equilibrium. Until and unless we see movement in inventory levels, do not expect much movement in home prices.

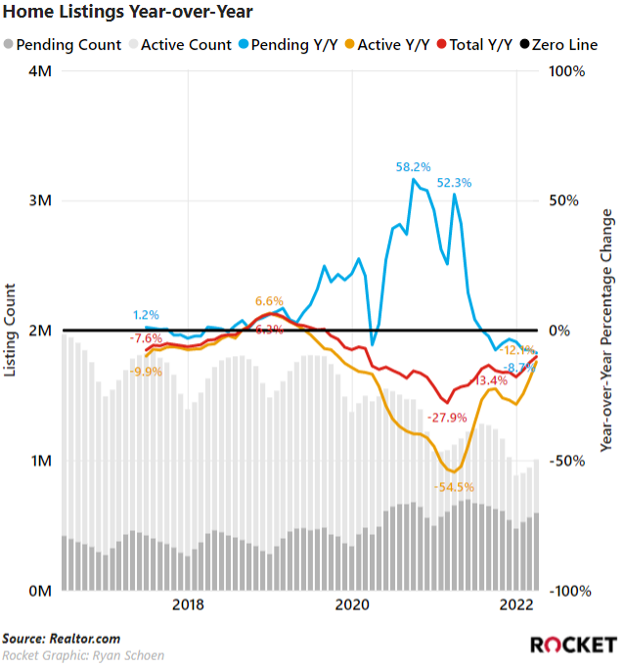

The good news, in terms of returning stability to home price growth, is that more recent indicators are pointing to some relief in housing supply as demand cools. In April, the national inventory of active listings declined by 12.2% over last year, while the total inventory of unsold homes, including pending listings, declined by just 10.7%. While these numbers remain negative, the trend is clearly moving north.

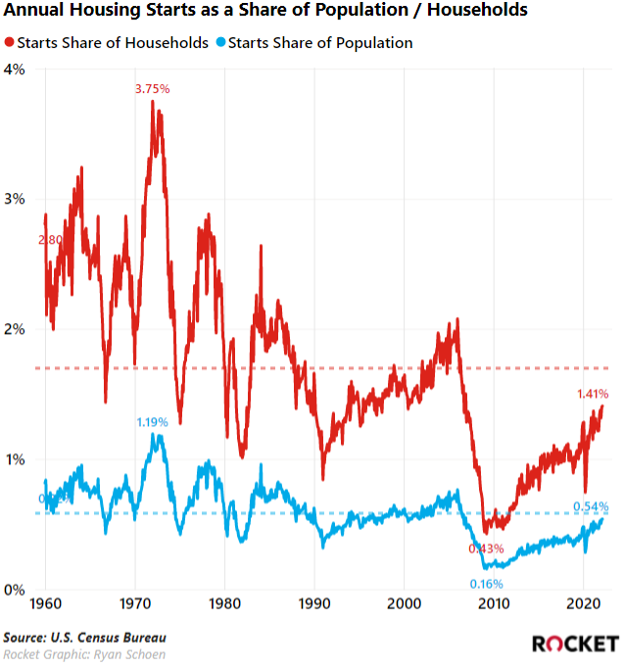

With the persistent underbuilding of housing units remaining in the marketplace, expectations are that it could be quite some time before supply reaches levels that will substantially move the needle on home prices. For would-be home buyers content with waiting things out for a “better deal,” you could be waiting quite some time. Despite 76% of consumers believing now is a bad time to buy a home, it is likely to get worse before it gets better, so it is in your best interests to act now.

Partner Spotlight: Marshall Gottlieb, CEO Of Agave Home Loans

Favorite things about Rocket:

- PathfinderSM by Rocket

- Team member responsiveness

- Built-in trust that team members will resolve issues when they come up

Wordle starting word: SMART

Favorite vacation spot: Charleston, SC

Coffee preference: Black, iced, with a shot of espresso (“I probably consume way too much caffeine …”)

First job: Little League umpire

Favorite local delicacy: Salt bagel with lox and all the fixings from JJ’s Delicatessen in Scottsdale, Arizona

The power of social media is undeniable. When it’s not being used to encourage users to try the latest viral challenge (milk crates are SO 2021), social media can be one of the most useful tools for an up-and-coming business to gain share at potentially no cost.

Marshall Gottlieb and his team at Agave Home Loans in Phoenix, Arizona, have relied heavily on social media in their first 2 years in business to create and cement their brand.

At first, Marshall and business partner Doug Wang’s focus was on organic lead generation rather than generating business through expensive marketing channels. But after gaining their foothold in the market, they’ve expanded their approach to building relationships with real estate agents and providing value to the community.

Real Estate Agent Relationships

Much like the Rocket Fuel Partner Spotlight, Agave Home Loans has developed their “REALTOR of the Week” series, which features local real estate agents across their social media channels.

“I started calling REALTORs I wanted to work with or who had done a loan with us in the past, even if they didn’t know who we were. … We chat, do the 15-20 minute interview, and then I send them the video that they can use themselves.”

Marshall recognizes that the entire industry is trying to win the real estate agent relationship, but that it’s more than just rates and process – you have to be able to network.

“REALTORs may not want to get coffee with LO’s, but we still want to help, so we promote them and try genuinely to help the agents however we can; if you stay top-of-mind, they might give you an opportunity to earn their business.”

Community Value

Agave Home Loans has also sought to use their social media presence to establish themselves as trusted resources amid the complicated personal finance world.

Their Instagram page is filled with 20- to 30-second clips of their own Loan Officers debunking myths, alongside helpful “Did You Know?” financial tips.

“Almost every personal finance tip is not about mortgages – it’s taxes, interest, psychological ways to approach money. … When you’re just providing mortgage tips, it’s more salesy.”

Instagram and TikTok also help Agave’s team show off their personalities; Marshall specifically called out taste tests that his team have done on pizza, hot sauces and more, all to show how their team is professional but also likes to have fun.

All told, whether it’s helping clients understand credit utilization rate or deciding which chicken nuggets are best, Marshall’s team is driven by one question: How do we provide our audience value?

--

For anyone looking to start building their own social media presence, Marshall offers a few pieces of advice:

- Be smart with timing: “Schedule it out and stick to it; you’re better to take a whole day once a month to film, write posts, etc.”

- Dive right in …: “There’s no perfect answer for what content to make, but it’s all about understanding your brand and what kind of value you want to put out there.”

- … but don’t be afraid to ask for help: “We couldn’t do this without Ashley LaMonica, the wife of one of our Loan Officers. She manages our social media at a super high level and helps hold us accountable.”

- Get your team on board: “We pay for an online graphic design interface for every employee who wants it. If we can get 50 of our employees posting on their own social accounts, then you’re getting a ton of impressions for your brand.”

In The Weeds Reads

- Fannie Mae: Consumer Sentiment Toward Housing Hits Lowest Level In Two Years

- Single-Family Home Prices Show Double-Digit Increase In 70% Of 185 Metro Areas In 2022 Q1

- Housing Affordability Takes A Hit In March

- Mortgage Credit Availability Decreased In April

- U.S. Foreclosure Activity Declines Slightly In April

TPO Travel

We had a packed house here in Detroit this week for All Access, part of Rocket Pro TPO’s Pro Performance training initiative. Reach out to your Account Executive about joining us for our next session!

Pro Puzzles

Zach A and JF were the only two to complete last week’s Mother’s Day puzzle in under a minute, with JF at 52 seconds and Zach leading all solvers at 36 seconds.

This week’s puzzle gets 2 out of 5 Rockets.